Question: How does calculating depreciation using the IRS tables, such as Table 5-6, differ from calculating depreciation using declining balance method used Example 5-3? In Table

How does calculating depreciation using the IRS tables, such as Table 5-6, differ from calculating depreciation using declining balance method used Example 5-3?

In Table 5-6

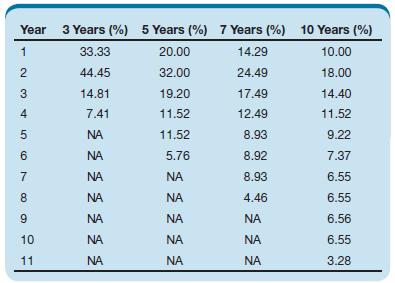

Year 1 234 5 6 7 8 9 10 11 3 Years (%) 5 Years (%) 7 Years (%) 10 Years (%) 33.33 20.00 14.29 10.00 44.45 32.00 24.49 18.00 14.81 19.20 17.49 14.40 7.41 11.52 12.49 11.52 11.52 8.93 9.22 5.76 8.92 8.93 4.46 NA 7.37 6.55 6.55 6.56 6.55 3.28

Step by Step Solution

3.37 Rating (169 Votes )

There are 3 Steps involved in it

The depreciation using the IRS tables is calculated ... View full answer

Get step-by-step solutions from verified subject matter experts