Question: How would your answers differ to Exercise 5 if this were an open-book negotiated project with a 7525% savings split favoring the project owner? Data

How would your answers differ to Exercise 5 if this were an open-book negotiated project with a 75–25% savings split favoring the project owner?

Data from exercise 5

Utilizing the buyout log developed in Exercise 1, if the project was to finish with exactly those buyout values equaling as-built costs, and all other estimated costs were to equal actual costs (which is unlikely), prepare a fee forecast for the project. What would the final fee for City Construction Company be? Would the owner realize any project savings? How would those savings be reflected in the final contract amount?

Data from exercise 1

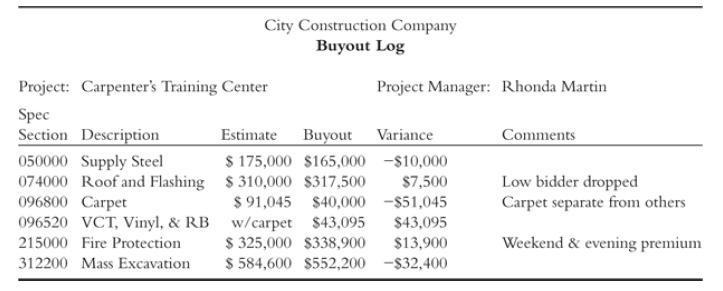

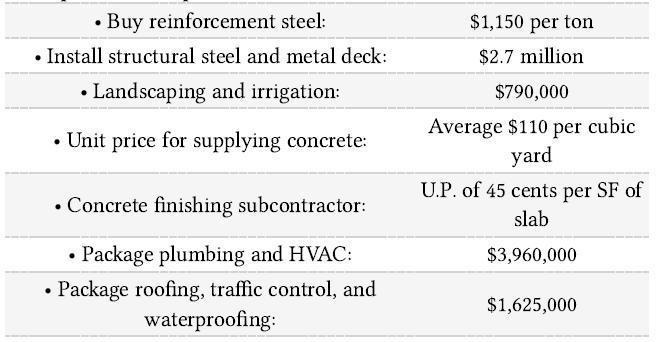

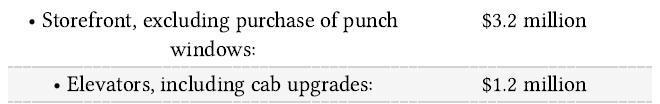

Assume the following buyout values for the case study project. Begin with the final bid estimate developed in Chapter 20 and develop a buyout log similar to Figure 24.2. You will have to look at examples presented earlier in the book and make a few derivations and assumptions to complete this exercise.

Figure 24.2

Project: Carpenter's Training Center Spec Section Description 050000 Supply Steel 074000 Roof and Flashing 096800 Carpet City Construction Company Buyout Log 096520 VCT, Vinyl, & RB 215000 Fire Protection 312200 Mass Excavation Project Manager: Rhonda Martin Estimate Buyout Variance $175,000 $165,000 -$10,000 $310,000 $317,500 $7,500 $91,045 $40,000 -$51,045 w/carpet $43,095 $43,095 $325,000 $338,900 $13,900 $584,600 $552,200 -$32,400 Comments Low bidder dropped Carpet separate from others Weekend & evening premium

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts