1. What fixed monthly payment is required to pay off a $5000 credit card balance in three...

Question:

1. What fixed monthly payment is required to pay off a $5000 credit card balance in three years if the interest rate is 21.1% compounded monthly?

2. What is the amount of interest you will pay?

3. If you were to increase your fixed payment on this same $5000 debt to $500 per month, how much less interest would you pay?

4. How long would it take you to pay off the debt?

Many Canadian banks and financial institutions have made it fairly easy for patrons to apply for and obtain their first credit card. Credit cards are a popular and convenient method of payment. When used responsibly, credit cards can help new users such as students establish a good credit history, which may benefit them when they need a loan or mortgage in the future. However, a credit card comes with inherent risks that post-secondary students might not immediately recognize.

Myth #1—Minimum payments will get you out of debt.

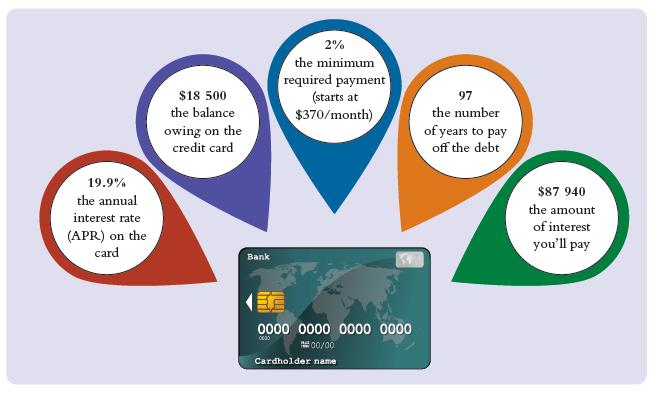

Before you apply for your first (or second, or third) credit card, consider the example depicted in the info graphic below.

Myth #2—A lender will only lend me what I can afford to repay.

Lenders base their calculations on your gross income (before tax), which is typically 20–30% higher than your take-home pay. What about emergencies? Only you know what you can afford.

Myth #3—Skipping payments isn’t a big deal.

This simply isn’t true! Skipping payments breaches the contract and can cause the lender to call out the full amount of the loan. If you must skip a payment, contact your lender immediately to work out a recovery plan. Ignoring your creditors will make the situation worse. Accepting a credit card is a legal agreement and creditors have the right to sue and collect the amount you owe.

Let’s go back to the original example. If you find you can’t pay your credit card off in full each month, then making slightly larger fixed payments will make a significant difference in terms of how long it will take you to pay off your credit card debt. Given the same $18 500 balance, and the same 19.9% annual interest rate, observe the impact of a $500 fixed payment made each month:

• 4.9—the number of years to pay off the debt

• $10 406—the amount of interest you’ll pay (that’s about $77 500 less than the interest based on the minimum payment!)

Step by Step Answer:

Contemporary Business Mathematics With Canadian Applications

ISBN: 9780135285015

12th Edition

Authors: Ali R. Hassanlou, S. A. Hummelbrunner, Kelly Halliday