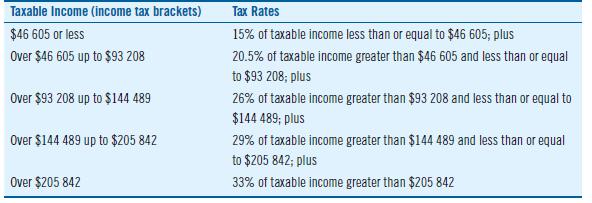

Use the 2018 federal income tax brackets and rates in Table 3.3 to answer the following question.

Question:

Use the 2018 federal income tax brackets and rates in Table 3.3 to answer the following question.

In early 2018, Mei Ling’s gross pay increased from $87 000 per year to $95 000 per year.

(a) What was the annual percent increase in Mei Ling’s pay before federal income taxes?

(b) What was the annual percent increase in Mei Ling’s pay after federal income taxes were deducted?

Table 3.3

Transcribed Image Text:

Taxable Income (income tax brackets) Tax Rates $46 605 or less 15% of taxable income less than or equal to $46 605; plus Over $46 605 up to $93 208 20.5% of taxable income greater than $46 605 and less than or equal to $93 208; plus Over $93 208 up to $144 489 26% of taxable income greater than $93 208 and less than or equal to $144 489; plus Over $144 489 up to $Z05 842 29% of taxable income greater than $144 489 and less than or equal to $205 842; plus Over $205 842 33% of taxable income greater than $205 842

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 53% (15 reviews)

a Mei Lings gross pay increased by 8000 95000 87000 The percent increase in her pay before federal i...View the full answer

Answered By

Nikka Ella Clavecillas Udaundo

I have a degree in psychology from Moi University, and I have experience working as a tutor for students in both psychology and other subjects. I am passionate about helping students learn and reach their potential, and I firmly believe that everyone has the ability to succeed if they receive the right support and guidance. I am patient and adaptable, and I will work with each individual student to tailor my teaching methods to their needs and learning style. I am confident in my ability to help students improve their grades and reach their academic goals, and I am excited to work with a new group of students.

0.00

0 Reviews

10+ Question Solved

Related Book For

Contemporary Business Mathematics With Canadian Applications

ISBN: 9780135285015

12th Edition

Authors: Ali R. Hassanlou, S. A. Hummelbrunner, Kelly Halliday

Question Posted:

Students also viewed these Mathematics questions

-

In early 2012, Mei Lings gross pay increased from $75 000 per year to $83 000 per year. (a) What was the annual percent increase in Mei Lings pay before federal income taxes? (b) What was the annual...

-

In early 2015, Mei Ling's gross pay increased from $75 000 per year to $83 000 per year. (a) What was the annual percent increase in Mei Ling's pay before federal income taxes? (b) What was the...

-

Use information from Table 16.2 to answer the following questions about sound in air. At 20oC the bulk modulus for air is 1.42 X 105 Pa and its density is 1.20 kg/m3. At this temperature, what are...

-

(a) Find the Maclaurin series for the function f(x)= ln(1+x) and hence that for In(1+x) (b) By keeping the first four terms in the Maclaurin series for In(1+x) integrate the function In(1+x) from x =...

-

What are soil horizons?

-

What is released in the formation of a condensation polymer?

-

Two heat exchangers are being considered for installation in a chemical plant. It is projected that: For an effective interest rate of \(10 \%\), determine the uniform end-of-year maintenance for...

-

Juda Company manufactures and sells a single product. The company's sales and expenses for last year follow: Requirements 1. Fill in the missing numbers in the table. Use the table to answer the...

-

Sweet Catering completed the following selected transactions during May 2016: May 1: Prepaid rent for three months, $1,200 May 5: Received and paid electricity bill, $130 May 9: Received cash for...

-

Use the guidelines of this section to sketch the curve. y = x 4 8x 2 + 8

-

Solve the following problem. Kims annual incomes for 2013, 2015, and 2017 were $50 000, $60 000, and $65 000, respectively. Given that the Consumer Price Index for the three years was 122.8, 126.6,...

-

Deli Delight budgets food costs to account for 40% and beverage costs to account for 35% of total costs. What is the ratio of food costs to beverage costs? Set up a ratio for each of the above and...

-

1. Complete Form 940, the Employer's Annual Federal Unemployment Tax Return. Assume that all wages have been paid and that all quarterly payments have been submitted to the state as required. The...

-

Your client want to have $168,313 in 20 years, how much money should he put in a savings account today? Assume that the savings account pays you 5.5 percent and it is compounded annually.

-

How Dominos Rose to the Top Problems/Issues; Possible Solutions; Recommend Solutions; and Expected Outcome?

-

What role does strategic foresight play in shaping strategic planning processes, particularly in anticipating and adapting to disruptive technological advancements, regulatory shifts, and...

-

Can you elaborate on the iterative nature of your strategic planning process, highlighting mechanisms for continuous learning, adaptation, and refinement in response to evolving environmental...

-

As a standard practice, the company does not recognize a provision for a guarantee of good operation of the products sold. Based on past statistics, the cost of repairing damage of products sold in...

-

Identify at least two potential negative outcomes of budgeting.

-

Which of the companies has the lowest accounts receivable turnover in the year 20X2? a. Company A. b. Company B. c. Company C. d. CompanyD. 20X1 20X2 Credit Sales Average Receivables Balance $1.0...

-

The balance in Marcs RRSPs was $148 000 when he converted to an RRIF. The RRIF pays $5000 at the end of each quarter. If interest on the RRIF is 4.3% compounded monthly, for how long will Marc...

-

Satwinder deposited $145 at the end of each month for 15 years at 7.5% compounded monthly. After her last deposit she converted the balance into an ordinary annuity paying $1200 every 3 months for 12...

-

Fred Larsen contributes $345 at the end of every 3 months into an RRSP. Interest on the account is 6% compounded monthly. (a) What will be the balance after nine years? (b) How much of the balance...

-

How can the circular wait condition be detected and broken to prevent deadlock in complex systems with multiple interdependent resources ?

-

Case Study 1\ You have been appointed as a financial analyst for the Axis International Company, a profitable retail company. The director of Finance, belonging to the capital budgeting division has...

-

How can I find a rival hypothesis for my current thesis of Walmart's CEO should implement intra-team communication for all associates to help with communication barriers between managers and...

Study smarter with the SolutionInn App