On January 2, 2013, the Hines Food Processing Company purchased a machine that dispenses a premeasured amount

Question:

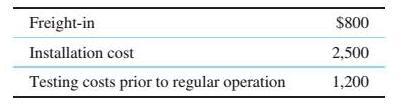

On January 2, 2013, the Hines Food Processing Company purchased a machine that dispenses a premeasured amount of tomato juice into a can. The machine cost $85,000. and its useful life was estimated at eight years. with a salvage value of $4,000. At the time it purchased the machine, Hines incurred the following additional expenses:

Book depreciation was calculated by the straight-line method, but for tax purposes. the machine was classified as a seven-year MACRS property. In January 2015. accessories costing $5,000 were added to the machine to reduce its operating costs. These accessories neither prolonged the machine’s life nor provided any additional salvage value.

(a) Calculate the book depreciation expense for2016.

(b) Calculate the tax depreciation expense for 2016.

Step by Step Answer: