The E. F. Fedele Company is considering acquiring an automatic screwing machine for its assembly operation of

Question:

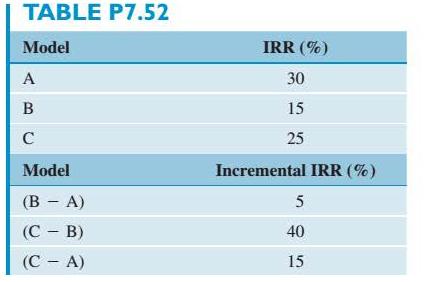

The E. F. Fedele Company is considering acquiring an automatic screwing machine for its assembly operation of a personal computer. Three different models with varying automatic features are under consideration. The required investments are $360,000 for model A, $380,000 for model B, and $405,000 for model C. All three models are expected w have the same service life of eight years. The financial information from Table P7.52, in which model (B — A) represents the increment al cash flow determined by subtracting model A’s cash flow from model B’s, is available. If the firm’s MARR is known to be 12%, which model should be selected?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: