Suppose a firm has no assets at t = 0, except an option to acquire an investment

Question:

Suppose a firm has no assets at t = 0, except an option to acquire an investment opportunity at t = 1 for $500 million.

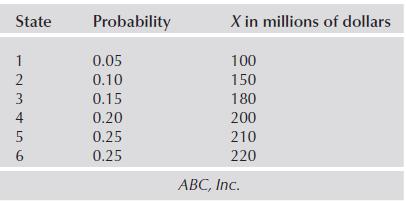

The outlay required for this investment will be raised entirely through a bank loan. There are no taxes and everybody is risk neutral. The investment opportunity, if undertaken, will yield a payoff of $ X per year perpetually, beginning at t = 2. However, what X will be is not known now. This knowledge will become available only at t = 1. Right now, we can only describe the possible values of X (at t = 1) by the following probability distribution.

The riskless rate (single-period) is 10%. Draw a graph that shows the relationship between the current market value of a perpetual (risky) bank loan for this form and the promised interest rate on this loan, which must be paid every year forever, and begins at t = 2.

Step by Step Answer:

Contemporary Financial Intermediation

ISBN: 9780124052086

4th Edition

Authors: Stuart I. Greenbaum, Anjan V. Thakor, Arnoud Boot