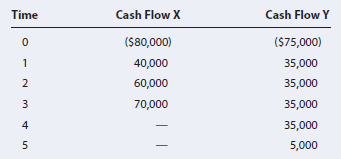

A firm has two mutually exclusive investment projects to evaluate. The projects have the following cash flows:

Question:

A firm has two mutually exclusive investment projects to evaluate. The projects have the following cash flows:

Projects X and Y are equally risky and may be repeated indefinitely. If the firm?s WACC is 10%, what is the EAA of the project that adds the most value to the firm? (Round your final answer to the nearest whole dollar.)

Transcribed Image Text:

Time Cash Flow X Cash Flow Y ($80,000) ($75,000) 1 40,000 35,000 2 60,000 35,000 3 70,000 35,000 4 35,000 5,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (8 reviews)

First solve for each projects NPV Project X CF 0 80000 CF 1 40000 CF 2 60000 CF 3 70...View the full answer

Answered By

Sandip Nandnawar

I am a B.E (Information technology) from GECA and also have an M.C.M from The University of RTMNU, MH.

I worked as a software developer (Programmer and TL). Also working as an expert for the last 6 years and deal with complex assessment and projects. I have a team and lead a team of experts and conducted primary and secondary research. I am a senior software engg and senior expert and deal with all types of CSE and IT and other IT-related assessments and projects and homework.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Fundamentals of Financial Management

ISBN: 978-1337395250

15th edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted:

Students also viewed these Business questions

-

A firm has two mutually exclusive investment projects to evaluate; both can be repeated indefinitely. The projects have the following cash flows: Projects X and Y are equally risky and may be...

-

Two mutually exclusive investment projects have the following forecasted cash flows: a. Compute the internal rate of return for each project. b. Compute the net present value for each project if the...

-

You recently went to work for Allied Components Company, a supplier of auto repair parts used in the after-market with products from Daimler, Chrysler, Ford, and other automakers. Your boss, the...

-

One way to delete nodes from a known position in a leftist heap is to use a lazy strategy. To delete a node, merely mark it deleted. When a findMin or deleteMin is performed, there is a potential...

-

What is a concurrency flaw?

-

Peter (Television) Ltd gives a 2-year labour and parts warranty on all television sets that it sells. The company has the following revenue for its first 2 years of trading: Based on the level of...

-

Pick an industry and a product or service. Engage in a creative-thinking process, as outlined in Chapter 11, to generate an improved offering. Do the same to create an entirely new offering that uses...

-

Lower-of-Cost-or-Market The inventory of Oheto Company on December 31, 2011, consists of the following items. (a) Determine the inventory as of December 31, 2011, by the lower-of-cost-or-market...

-

The force exerted by a 2.4-m massless string on a 0.84-kg object being swung in a horizontal circle is 4.2 N. What is the tangential velocity of the object?

-

Steven owns and runs a store called Zodiac General Dealer. He allows goods to be sold on credit. Zodiac's year-end is 28 February. Steven went over all information pertaining to debtors to find out...

-

The Lesseig Company has an opportunity to invest in one of two mutually exclusive machines that will produce a product the company will need for the next 8 years. Machine A costs $8.9 million but...

-

Holmes Manufacturing is considering a new machine that costs $250,000 and would reduce pretax manufacturing costs by $90,000 annually. Holmes would use the 3-year MACRS method to depreciate the...

-

Calculate the pH and pOH of each of the following aqueous solutions of strong acid or base: (a) 0.0356 m HI(aq); (b) 0.0725 m HCl(aq); (c) 3.46 * 10 3 m Ba(OH) 2 (aq); (d) 10.9 mg of KOH dissolved...

-

A sample of collagen fiber with a cross-sectional area of 1.210 7 m 2 is hung from a fixed support, and a gradually increasing load is applied to the lower end. The tensile strength of collagen (i.e....

-

Consider an investment where the cash flows are: -$994.39 at time t= 0 (negative since this is your initial investment) $331 at time f = 1 in years $432 at time r = 2 in years $310 at time r = 3 in...

-

Economic Shelly and Ron are roommates. Their apartment has a fixed monthly rent, and a small water heater. Draw an Edgeworth box with rent on the horizontal axes and hot water on the vertical axes....

-

Bellamy describes video she has seen that bears witness to brutality against Black bodies. You'll need to read her whole essay in order to respond here, but I want you to focus on her illustrations...

-

Ariely argues that "there was no market for Tahitian black pearls and little demand." What elements of a market were missing and how did "the pearl king" change that? What is imprinting and anchor...

-

The following summary of the payout, dividend yield, and earnings per share ratios is available for five years ended December 31 for TransAlta Corporation: Instructions (a) What are some possible...

-

The Strahler Stream Order System ranks streams based on the number of tributaries that have merged. It is a top-down system where rivers of the first order are the headwaters (aka outermost...

-

Calculate the required rate of return for Manning Enterprises assuming that investors expect a 3.5% rate of inflation in the future. The real risk-free rate is 2.5%, and the market risk premium is...

-

Suppose rRF = 9%, rM = 14%, and bi = 1.3. a. What is ri, the required rate of return on Stock i? b. Now suppose that rRF (1) increases to 10% or (2) decreases to 8%. The slope of the SML remains...

-

Consider the following information for three stocks, Stocks X, Y, and Z. The returns on the three stocks are positively correlated, but they are not perfectly correlated. (That is, each of the...

-

All scheduled presentations and events will take place in the Main Conference Room, 1st Floor. Time February 25 Registration Guide to the Job Fair Rsum Writing Lunch (refreshments served) The...

-

You have work experience in the human resource management field. You want to further understand what factors make a project successful. You are particularly interested in employee selection and...

-

How many defects must a unit have in order to be defined as a defective unit?

Study smarter with the SolutionInn App