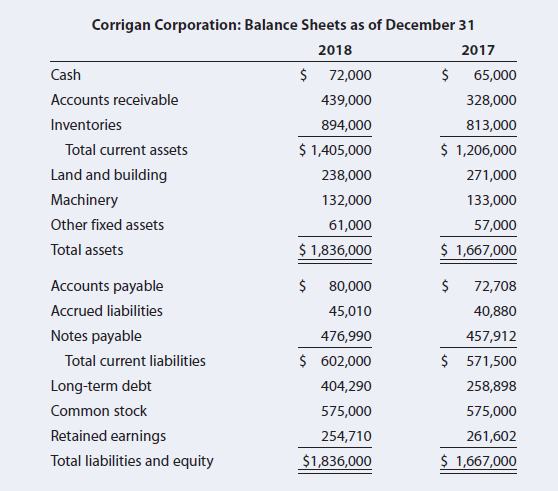

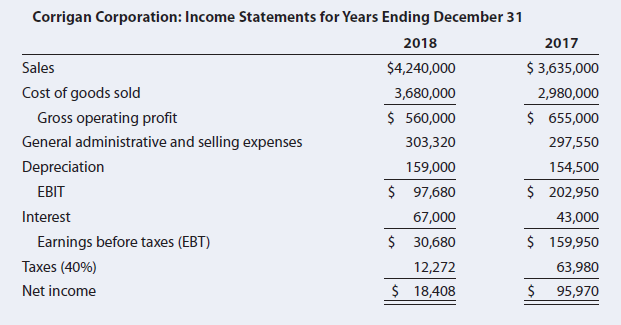

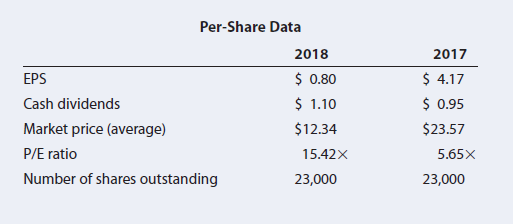

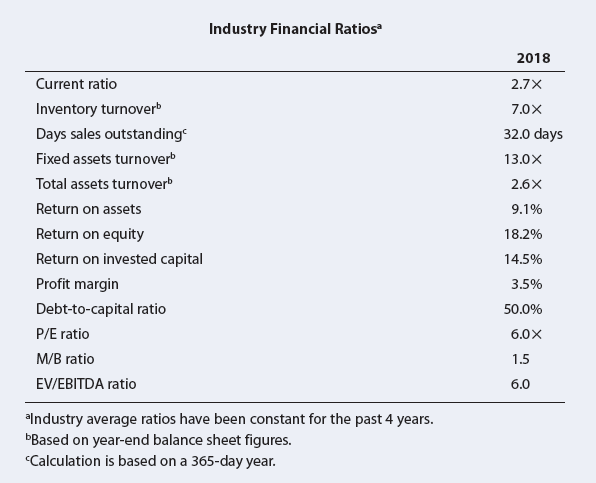

The Corrigan Corporations 2017 and 2018 financial statements follow, along with some industry average ratios. a. Assess

Question:

a. Assess Corrigan€™s liquidity position, and determine how it compares with peers and how the liquidity position has changed over time.

b. Assess Corrigan€™s asset management position, and determine how it compares with peers and how its asset management efficiency has changed over time.

c. Assess Corrigan€™s debt management position, and determine how it compares with peers and how its debt management has changed over time.

d. Assess Corrigan€™s profitability ratios, and determine how they compare with peers and how its profitability position has changed over time.

e. Assess Corrigan€™s market value ratios, and determine how its valuation compares with peers and how it has changed over time. Assume the firm€™s debt is priced at par, so the market value of its debt equals its book value.

f. Calculate Corrigan€™s ROE as well as the industry average ROE, using the DuPont equation. From this analysis, how does Corrigan€™s financial position compare with the industry average numbers?

g. What do you think would happen to its ratios if the company initiated cost-cutting measures that allowed it to hold lower levels of inventory and substantially decreased the cost of goods sold? No calculations are necessary. Think about which ratios would be affected by changes in these two accounts.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Financial Management

ISBN: 978-1337395250

15th edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted: