The Paulson Company?s year-end balance sheet is shown below. Its cost of common equity is 14%, its

Question:

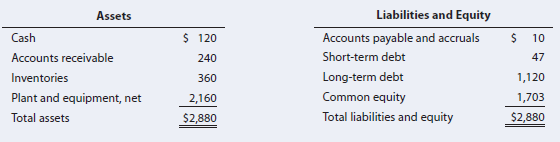

The Paulson Company?s year-end balance sheet is shown below. Its cost of common equity is 14%, its before-tax cost of debt is 10%, and its marginal tax rate is 40%.Assume that the firm?s long-term debt sells at par value. The firm?s total debt, which is the sum of the company?s short-term debt and long-term debt, equals $1,167. The firm has 576 shares of common stock outstanding that sell for $4.00 per share. Calculate Paulson?s WACC using market-value weights.

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Cost Of Debt

The cost of debt is the effective interest rate a company pays on its debts. It’s the cost of debt, such as bonds and loans, among others. The cost of debt often refers to before-tax cost of debt, which is the company's cost of debt before taking...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Financial Management

ISBN: 978-1337395250

15th edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted: