Rowlock Ltd. was incorporated on 1st October, 2016 to acquire Rowlocks mail order business, with effect from

Question:

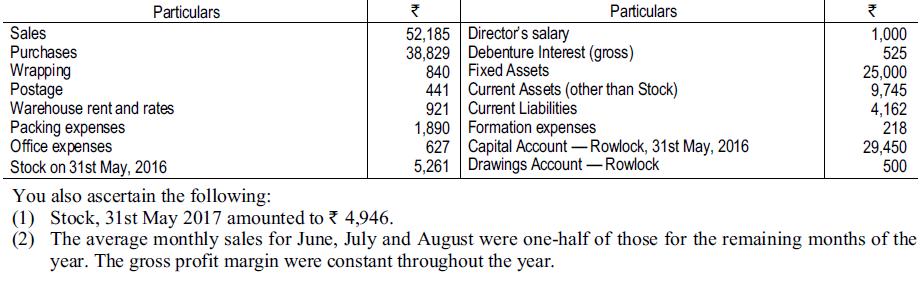

Rowlock Ltd. was incorporated on 1st October, 2016 to acquire Rowlock’s mail order business, with effect from 1st June, 2016. The purchase consideration was agreed at ~ 35,000 to be satisfied by the issue on 1st December, 2016 to Rowlock or his nominee of: 20,000 equity shares of Re 1 each, fully paid and ~ 15,000, 7% Debentures. The entries relating to the transfer were not made in the books which were carried on without a break until 31st May, 2017. On 1st May, 2017 the Trial Balance extracted from the books showed the following:

(3) Wrapping, postage and packing expenses varied in direct proportion to sales, while office expenses were constant each month.

(4) Formation expenses are to be written off. You are required to prepare the Trading and Profit and Loss Account for the year ended 31st May, 2017 apportioned between the periods before and after incorporation and Balance Sheet as on the date.

Step by Step Answer:

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee