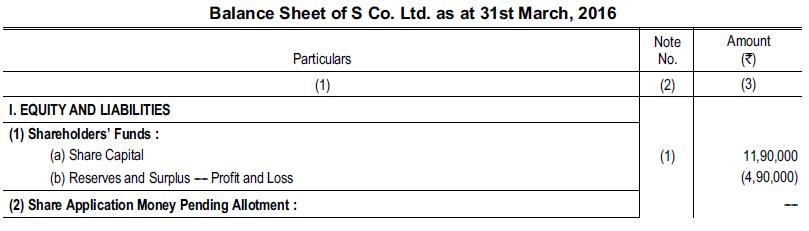

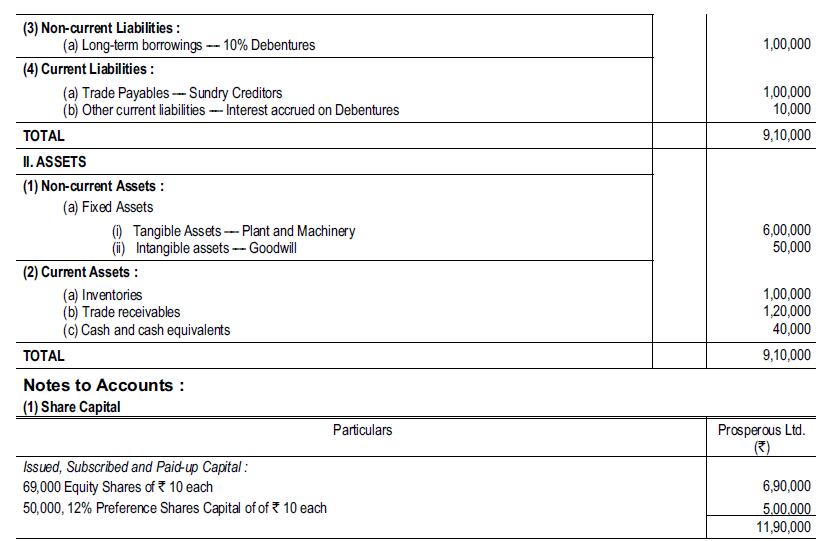

The following abridged Balance Sheet of S Co Ltd. as on 31.3.2016 is given below: The following

Question:

The following abridged Balance Sheet of S Co Ltd. as on 31.3.2016 is given below:

The following scheme of reconstruction has been sanctioned by the court:

(1) A new company S S Co Ltd. is formed with 1,00,000 equity shares of ₹ 10 each.

(2) The new company will acquire all the assets and liabilities of S Co Ltd. on the following terms:

(a) Old company’s debentures are paid by similar debentures in the new company. The outstanding interest on debentures are paid by the new company by issuing equal amount of equity shares at par.

(b) The creditors are paid for every ₹ 100 dues ₹ 15 in cash and 10 equity shares issued at par.

(c) Preference shareholders are to get equal number of equity shares, and for 1 year’s arrear dividend, these shareholders will get 5 equity shares at par for each ₹ 100 due.

(d) The equity shareholders will get 1 equity share in the new company in exchange of 3 shares held.

(e) The new company will bear the reconstruction expenses of ₹ 10,000.

(3) Current assets are to be taken at their book values (except inventories which is to be reduced by ₹ 30,000).

(4) Remaining shares of the new company are to be issued at par and be fully paid. Assuming the above scheme has been implemented, you are to show:

(a) In the books of S Co Ltd.:

(i) New Company’s Account;

(ii) Realisation and Reconstruction (combined) Account;

(iii) Equity Shareholders Account.

(b) In the books of S S Co Ltd.:

(i) Journal entries recording the acquisition and other transactions; and

(ii) Summarised Balance Sheet.

Step by Step Answer:

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee