Suppose the current zero-coupon yield curve for risk-free bonds is as follows: a. What is the price

Question:

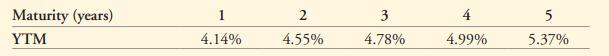

Suppose the current zero-coupon yield curve for risk-free bonds is as follows:

a. What is the price per $100 face value of a three-year, zero-coupon, risk-free bond?

b. What is the price per $100 face value of a four-year, zero-coupon, risk-free bond?

c. What is the risk-free interest rate for a four-year maturity?

Transcribed Image Text:

Maturity (years) YTM 1 4.14% 2 4.55% 3 4.78% 4 4.99% 5 5.37%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

a To calculate the price per 100 face value of a threeyear zerocoupon riskfree bond we need to disco...View the full answer

Answered By

Jonas Araujo

I have recently received the degree of PhD. In Physics by the Universidade Federal do Maranhão after spending a term in Durham University, as I have been awarded a scholarship from a Brazilian mobility program. During my PhD. I have performed research mainly in Theoretical Physics and published works in distinguished Journals (check my ORCID: https://orcid.org/0000-0002-4324-1184).

During my BSc. I have been awarded a scholarship to study for a year in the University of Evansville, where I have worked in detection-analysis of photon correlations in the the Photonics Laboratory. There I was a tutor in Electromagnetism, Classical Mechanics and Calculus for most of that year (2012).

I am very dedicated, honest and a fast learner, but most of all, I value a job well done.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Corporate Finance The Core

ISBN: 9781292158334

4th Global Edition

Authors: Jonathan Berk, Peter DeMarzo

Question Posted:

Students also viewed these Business questions

-

Risk Measurement, Dollar Duration, Convexity, and Macaulay Duration - 30 points The following discount factors are given: B(0, 1) = 0.92506 B(0, 2) = 0.88145 B(0, 3) = 0.83476 B(0, 4) = 0.79821 As a...

-

1. Myra Breck must choose between two bonds: Bond A pays $120 annual interest with semiannual payment and has a market value of $760. It has 10 years to maturity. Bond B pays $120 annual interest...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

A car is randomly selected at a traffic safety checkpoint, and the car has 6 cylinders. Determine whether the given values are from a discrete or continuous data set.

-

1. Three people are chosen at random. What is the probability that at least two of them were born on the same day of the week? 2. Four people are chosen at random. What is the probability that at...

-

Write one application of each: (a) Affinity diagram. (b) Relations diagram. (c) Systematic or tree diagram. (d) Matrix diagram. (f) Matrix data analysis. (g) Arrow diagram. (h) Process decision...

-

How is the name of a use case determined?

-

On January 2, 2010, Quo, Inc. hired Reed as its controller. During the year, Reed, working closely with Quos president and outside accountants, made changes in accounting policies, corrected several...

-

What I learnt? Customer Behaviour: 1) Customer satisfaction only results in loyalty at the highest level of satisfaction - do not focus entirely on satisfaction 2) Improvements that are not...

-

In the Global Financial Crisis box in Section 6.1, www.Bloomberg.com reported that the threemonth Treasury bill sold for a price of $100.002556 per $100 face value. What is the yield to maturity of...

-

A five-year bond with a face value of $1000 has a coupon rate of 6.5%, with semiannual payments. a. What is the coupon payment for this bond? b. Draw the cash flows for the bond on a timeline.

-

Estimate process capability using the x and R charts for the power supply voltage data in Exercise 6.8 (note that early printings of the 7th edition indicate Exercise 6.2). If specifications are at...

-

The telephone system uses geographical addressing. Why do you think this was not adopted as a matter of course by the Internet?

-

Consider the following Ethernet model. Transmission attempts are made at random times with an average spacing of slot times; specifically, the interval between consecutive attempts is an exponential...

-

Find or install an encryption utility (e.g., the Unix des command or pgp) on your system. Read its documentation and experiment with it. Measure how fast it is able to encrypt and decrypt data. Are...

-

Write a test program that uses the socket interface to send messages between a pair of Unix workstations connected by some LAN (e.g., Ethernet, ATM, or FDDI). Use this test program to perform the...

-

Suppose we want returning RTCP reports from receivers to amount to no more than 5% of the outgoing primary RTP stream. If each report is 84 bytes, the RTP traffic is 20 kBps, and there are 1000...

-

Lee Rex Company is considering an investment that costs $250,000 today and will provide $40,000 each year in net cash inflow, but the company is not sure how long the investment will last. The...

-

Use this circle graph to answer following Exercises. 1. What fraction of areas maintained by the National Park Service are designated as National Recreation Areas? 2. What fraction of areas...

-

For the portfolio in Problem 23, if the correlation between Johnson & Johnsons and Walgreens stock were to increase, a. Would the expected return of the portfolio rise or fall? b. Would the...

-

Returning to Problem 38, assume you follow your brokers advice and put 50% of your money in the venture fund. a. What is the Sharpe ratio of the Tanglewood Fund? b. What is the Sharpe ratio of your...

-

Using the same data as in Problem 11, estimate the 95% confidence interval for the alpha and beta of Nike and Dell stock using Excels regression tool (from the data analysis menu) or the linest()...

-

Kyler ( ordinary rate of 3 5 % in this question; regular capital gains rate of 1 5 % ) purchased Wong stock for $ 4 0 0 in February of 2 0 2 2 . In November of 2 0 2 2 , the stock had appreciated to...

-

On December 3 1 , 2 0 2 4 , the end of the fiscal year, California Microtech Corporation completed the sale of its semiconductor business for $ 1 8 million. The semiconductor business segment...

-

Yancey Productions is a film studio that uses a job - order costing system. The company s direct materials consist of items such as costumes and props. Its direct labor includes each film s actors,...

Study smarter with the SolutionInn App