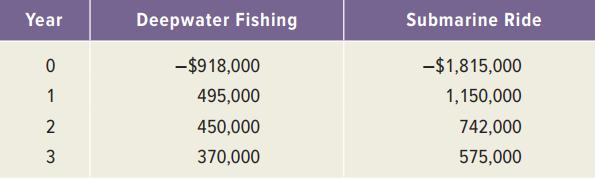

Consider the following cash flows on two mutually exclusive projects for the Bahamas Recreation Corporation. Both projects

Question:

Consider the following cash flows on two mutually exclusive projects for the Bahamas Recreation Corporation. Both projects require an annual return of 15 percent.

As a financial analyst for the company, you are asked the following questions.

a. If your decision rule is to accept the project with the greater IRR, which project should you choose?

b. Because you are fully aware of the IRR rule’s scale problem, you calculate the incremental IRR for the cash flows. Based on your computation, which project should you choose?

c. To be prudent, you compute the NPV for both projects. Which project should you choose? Is it consistent with the incremental IRR rule?

Step by Step Answer:

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan