For 2020, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders.

Question:

For 2020, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders.

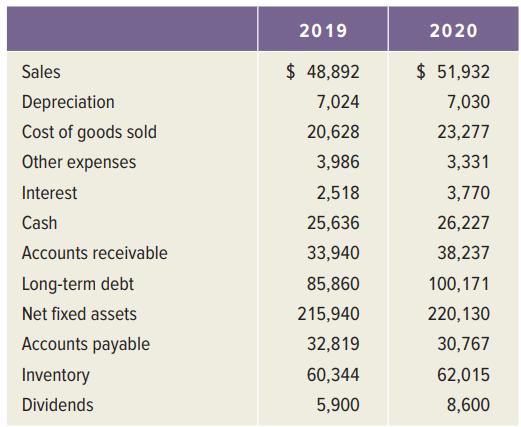

Use the following information for Ingersoll, Inc., (assume the tax rate is 25 percent):

2019 2020 Sales $ 48,892 $ 51,932 Depreciation 7,024 7,030 Cost of goods sold 20,628 23,277 Other expenses 3,986 3,331 Interest 2,518 3,770 Cash 25,636 26,227 Accounts receivable 33,940 38,237 Long-term debt 85,860 100,171 Net fixed assets 215,940 220,130 Accounts payable 32,819 30,767 Inventory 60,344 62,015 Dividends 5,900 8,600

Step by Step Answer:

OCF EBIT Depreciation Taxes OCF 18294 7030 3631 OCF 21693 Change in NWC NWCend NWCbeg CA CLend CA CL...View the full answer

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

For 2012, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. Use the following information for Ingersoll, Inc., for (assume the tax rate is 34percent): 2011...

-

For 2017, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. Use the following information for Ingersoll, Inc., (assume the tax rate is 35 percent): 2016 2017...

-

Deep Water Experts is the largest retailer of diving equipment for professional and recreational divers in the UAE. The company was founded in 2005 as a joint partnership and has experienced...

-

Which of the following is not an element of the fraud triangle? (a) Rationalization. (b) Financial pressure. (c) Segregation of duties. (d) Opportunity.

-

Recall that phishing describes an attempt to extract personal/financial information from unsuspecting people through fraudulent e-mail. The interarrival times (in seconds) for 267 fraud box e-mail...

-

From the following data, calculate the Retained Earnings balance as of December 31, 2019: Retained earnings, December 31, 2020 ....................................................$367,800 Net...

-

The standard for a process producing tin plate in a continuous strip is 5 defects in the form of pinholes or visual blemishes per 100 feet. Based on the following set of 25 observations, giving the...

-

The seasonal yield of olives in a Piraeus, Greece vineyard is greatly influenced by a process of branch pruning. If olive trees are pruned every two weeks, output is increased. The pruning process,...

-

Find y'' for y = 2+ y" = 53 X

-

Let F be any function whose domain contains - x when-ever it contains x. Prove each of the following. (a) F(x) - F (- x) is an odd function. (b) F(x) + F(- x) is an even function. (c) F can always be...

-

Draw up an income statement and balance sheet for this company for 2019 and 2020. Use the following information for Ingersoll, Inc., (assume the tax rate is 25 percent): 2019 2020 Sales $ 48,892 $...

-

If Hailey, Inc., has an equity multiplier of .85, total asset turnover of 2.10, and a profit margin of 5.97 percent, what is its ROE?

-

The two major components of the atmosphere are the diatomic molecules of nitrogen and oxygen. Explain why pure nitrogen is used as a protective atmosphere in the laboratory and pure oxygen is much...

-

After a government implements a voucher pro- gram, granting funds that families can spend at schools of their choice, numerous students in public schools switch to private schools. The program's...

-

In a perfectly competitive market, price equals marginal cost, but this condition is not satisfied for the firm with the revenue and cost conditions depicted in Problem 25-2. In the long run, what...

-

Lakepointe Senior Care & Rehab, LLC, operates a long-term care facility in Michigan. It employs licensed practical nurses and registered nurses, which together are called charge nurses. The National...

-

Given the truth values \(A\) false, \(B\) true, and \(C\) true, what is the truth value of each of the following wffs? a. \(A ightarrow(B \vee C)\) b. \((A \vee B) ightarrow C\) c. \(C...

-

Consider Figure 4-1. The current demand and supply curves are D 1 , and S 1 , at which the equilibrium price and quantity are P 1 and Q 1 . If firms adopt a cost-reducing technique for producing this...

-

Alpha Corporation owns 100 percent of Beta Company, and Beta owns 80 percent of Many of the natural product molecules synthesized by plants are formed by the joining together of isoprene monomers via...

-

Define the term utility software and give two examples.

-

Growth Rate In the context of the dividend growth model, is it true that the growth rate in dividends and the growth rate in the price of the stock are identical?

-

Growth Rate In the context of the dividend growth model, is it true that the growth rate in dividends and the growth rate in the price of the stock are identical?

-

Voting Rights When it comes to voting in elections, what are the differences between US political democracy and U.S. corporate democracy?

-

Golden Gate Mining Co. (GGMC) currently has a gold mine operating in Canada and is looking to purchase another gold mine in Peru, operating as Inca Gold Inc. (ICI). You currently work for the CFO at...

-

Cokolo Inc. has entered into the following two derivatives contracts: Purchased put options on 1,000 Trenton Co. shares that have an exercise price of $52 per share and expire in 60 days Negotiated a...

-

As a financial manager (consultant), undertake an investigation on your allocated company to evaluate its strategic financial position. Prepare a business report for the board of directors of the...

Study smarter with the SolutionInn App