Greystone, Inc., has the following mutually exclusive projects. a. Suppose the companys payback period cutoff is two

Question:

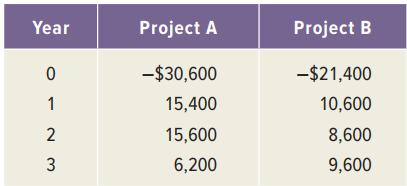

Greystone, Inc., has the following mutually exclusive projects.

a. Suppose the company’s payback period cutoff is two years. Which of these two projects should be chosen?

b. Suppose the company uses the NPV rule to rank these two projects. Which project should be chosen if the appropriate discount rate is 15 percent?

Year Project A Project B -$30,600 -$21,400 15,400 10,600 2 15,600 8,600 6,200 9,600 1, 3.

Step by Step Answer:

a The payback period is the time that it takes for the cumulative undiscounted cash inflows to equal ...View the full answer

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Related Video

NPV stands for \"Net Present Value,\" which is a financial concept used to determine the value of an investment or project. It measures the difference between the present value of cash inflows and the present value of cash outflows over a given period of time, using a specific discount rate. To calculate the NPV of an investment, you need to first estimate the cash inflows and outflows associated with the investment, and then discount them back to their present values using a discount rate. The discount rate represents the cost of capital or the expected rate of return required by investors. The formula for calculating NPV is: NPV = sum of (cash inflows / (1 + discount rate)^t) - sum of (cash outflows / (1 + discount rate)^t) Where: Cash inflows: the expected cash received from the investment Cash outflows: the expected cash paid out for the investment Discount rate: the required rate of return or the cost of capital t: the time period in which the cash flow occurs If the NPV is positive, it means that the investment is expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a good investment. If the NPV is negative, it means that the investment is not expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a bad investment.

Students also viewed these Business questions

-

Tri Star, Inc., has the following mutually exclusive projects. a. Suppose the companys payback period cutoff is two years. Which of these two projects should be chosen? b. Suppose the company uses...

-

Inc., has the following mutually exclusive projects. a. Suppose the company?s payback period cutoff is two years. Which of these two projects should be chosen? b. Suppose the company uses the NPV...

-

Fuji Software, Inc., has the following mutually exclusive projects. a. Suppose Fujis payback period cutoff is two years. Which of these two projects should be chosen? b. Suppose Fuji uses the NPV...

-

During a worldwide recession in 1983, the oil cartel began to lower prices. Why would a recession make the cartel more vulnerable to price cutting? How would the reduced demand be shared between the...

-

Six Sigma is a comprehensive approach to quality goal setting that involves statistics. An article in Aircraft Engineering and Aerospace Technology (Vol. 76, No. 6, 2004) demonstrated the use of the...

-

Jasmine Manufacturing wishes to maintain a sustainable growth rate of 7 percent a year, a debt-equity ratio of .65, and a dividend payout ratio of 25 percent. The ratio of total assets to sales is...

-

In some reliability problems we are concerned only with initial failures, treating a component as if (for all practical purposes) it never fails, once it has survived past a certain time...

-

In January 2015, Mitzu Co. pays $2,600,000 for a tract of land with two buildings on it. It plans to demolish Building 1 and build a new store in its place. Building 2 will be a company office; it is...

-

As a consultant, you have been tasked with determining whether the given borehole water supply is suitable for domestic use, in terms of hardness. As such, you carry out a chemical analysis on the...

-

Find A2 if a) A = {0, 1, 3}. b) A = {1, 2, a, b}.

-

1. Construct a spreadsheet to calculate the payback period, internal rate of return, modified internal rate of return, and net present value of the proposed mine. 2. Based on your analysis, should...

-

An investment project provides cash inflows of $1,530 per year for eight years. What is the project payback period if the initial cost is $4,900? What if the initial cost is $7,900? What if it is...

-

Fill in the table below with the key performance features of controllable power electronics switches covered in this chapter. TABLE Q14.1 Key Performance Features of Controllable Power Electronics...

-

In Problems 12-15, match each formula in Column A with the type of financial problem in Column B. Column A 13. P m - (1+) r 11 Column B Amortization

-

In how many ways can a group of 15 people elect a president, vice president, and secretary?

-

Putt Corporation acquired 70 percent of Slice Companys voting common stock on January 1, 20X3, for $158,900. Slice reported common stock outstanding of $100,000 and retained earnings of $85,000. The...

-

Explain, giving a suitable example in each case, how management accounting may serve the purposes of: (a) directing attention (b) keeping the score (c) solving problems.

-

Use a calculator to evaluate the present value of an annuity formula \[P=m\left[\frac{1-\left(1+\frac{r}{n}ight)^{-n t}}{\frac{r}{n}}ight]\] for the values of the variables \(m, r\), and \(t\)...

-

On October 2, 2016, Flx, a U.S. company, entered into a forward contract to purchase 50,000 euros for delivery in 180 days at a forward rate of $0.6350. The forward contract is a derivative...

-

What is the order p of a B + -tree? Describe the structure of both internal and leaf nodes of a B + -tree.

-

You purchase one call and sell one put with the same strike price and expiration date. What is the delta of your portfolio? Why?

-

In addition to spinners and scroll bars, there are numerous other controls in Excel. For this assignment, you need to build a Black-Scholes Option Pricing Model spreadsheet using several of these...

-

In addition to spinners and scroll bars, there are numerous other controls in Excel. For this assignment, you need to build a Black-Scholes Option Pricing Model spreadsheet using several of these...

-

After you've completed this week's assigned reading, watch the video below. Next, respond to the Discussion questions underneath. Your first post should answer those questions and should be made by...

-

Factorize (x4 - 20x + 100)

-

Paragraph discussing food insecurity in the United States. What agencies in the federal government play an important role in ameliorating this situation? What groups of people are at particular risk?

Study smarter with the SolutionInn App