In the previous problem, suppose the company has announced it is going to repurchase $12,160 worth of

Question:

In the previous problem, suppose the company has announced it is going to repurchase $12,160 worth of stock. What effect will this transaction have on the equity of the firm? How many shares will be outstanding? What will the price per share be after the repurchase? Ignoring tax effects, show how the share repurchase is effectively the same as a cash dividend.

Data from Previous Problem

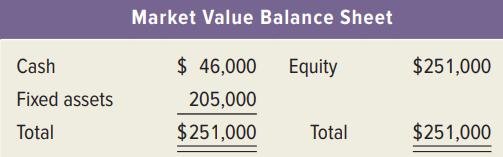

The balance sheet for Kare Corp. is shown here in market value terms. There are 6,400 shares of stock outstanding.

The company has declared a dividend of $1.90 per share. The stock goes ex dividend tomorrow. Ignoring any tax effects, what is the stock selling for today? What will it sell for tomorrow? What will the balance sheet look like after the dividends are paid?

Step by Step Answer:

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan