Sony International has an investment opportunity to produce a new stereo HDTV. The required investment on January

Question:

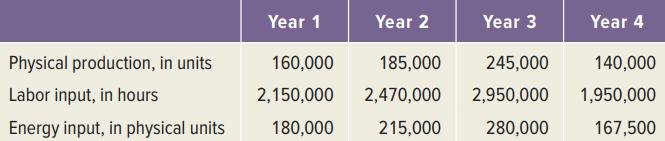

Sony International has an investment opportunity to produce a new stereo HDTV. The required investment on January 1 of this year is $95 million. The firm will depreciate the investment to zero using the straight-line method over four years. The investment has no resale value after completion of the project. The tax rate is 21 percent. The price of the product will be $515 per unit, in real terms, and will not change over the life of the project. Labor costs for Year 1 will be $20.43 per hour in real terms, and will increase at 2 percent per year in real terms. Energy costs for Year 1 will be $6.25 per physical unit, in real terms, and will increase at 3 percent per year in real terms. The inflation rate is 4 percent per year. Revenues are received and costs are paid at year-end. Refer to the table below for the production schedule.

The real discount rate for the project is 8 percent. Calculate the NPV of this project.

Step by Step Answer:

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan