Suppose you observe the following situation: a. Calculate the expected return on each stock. b. Assuming the

Question:

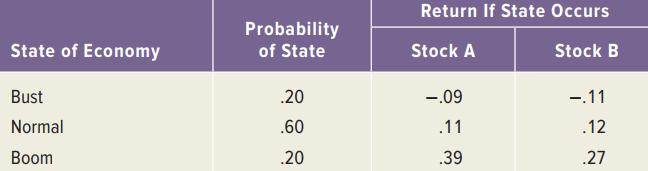

Suppose you observe the following situation:

a. Calculate the expected return on each stock.

b. Assuming the capital asset pricing model holds and Stock A’s beta is greater than Stock B’s beta by .34, what is the expected market risk premium?

Transcribed Image Text:

Return If State Occurs Probability State of Economy of State Stock A Stock B Bust .20 -.09 -.11 Normal .60 .11 .12 Boom .20 .39 .27

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 62% (8 reviews)

a The expected return of an asset is the sum of the probability of each return occurring times the p...View the full answer

Answered By

Hassan Ali

I am an electrical engineer with Master in Management (Engineering). I have been teaching for more than 10years and still helping a a lot of students online and in person. In addition to that, I not only have theoretical experience but also have practical experience by working on different managerial positions in different companies. Now I am running my own company successfully which I launched in 2019. I can provide complete guidance in the following fields. System engineering management, research and lab reports, power transmission, utilisation and distribution, generators and motors, organizational behaviour, essay writing, general management, digital system design, control system, business and leadership.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

Suppose you observe the following situation: a. Calculate the expected return on each stock. b. Assuming the capital asset pricing model holds and Stock As beta is greater than Stock Bs beta by .43,...

-

Suppose you observe the following situation: a. Calculate the expected return on each stock. b. Assuming the capital asset pricing model holds and stock As beta is greater than stock Bs beta by .40,...

-

SML Suppose you observe the following situation: a. Calculate the expected return on each stock. b. Assuming the capital asset pricing model holds and stock A??s beta is greater than stock B??s beta...

-

A semicircular plate of radius r, oriented as in the figure, is submerged in fluid of density 68 lb/ft 3 so that its diameter is located at a depth of m feet. Calculate the force on one side of the...

-

Hierarchical file names always start at the top of the tree. Consider, for example, the file name /usr/ast/books/mos2/chap-12 rather than chap-12/mos2/books/ast/usr. In contrast, DNS names start at...

-

Using the trial balance provided above, prepare an income statement and a statement of changes in equity for the first three months ended July 31, 2020, and a balance sheet at July 31, 2020. Analysis...

-

Tomlinsons Lumens, Inc. (TLI) is a large manufacturer of lighting fixtures and parts. TLAs Accounting department receives files tomlinsonprices and tomlinsonunits that summarize the price and units...

-

Ficus Tree Farm issued five $1,000 bonds with a stated annual interest rate of 12 percent on January 1, 2018. The bonds mature on January 1, 2023. Interest is paid semiannually on June 30 and...

-

mment T4075 As CIT-1075 (1%) Consider ment CCIT 1075 Assignmes m-1 n=0 Consider the dataset {9}-0 Assume m is a multiple of (a) (1%) Suppose 9 = cos(2/3). Estimate the pmf of the random variable...

-

1. How does the use of HR forecasting reflect Honeywell's strategy and culture? 2. Which quantitative or qualitative manpower forecasting method do you believe Honeywell used to decide to move...

-

The Angelina Corporations common stock has a beta of 1.08. If the risk-free rate is 3.7 percent and the expected return on the market is 10 percent, what is the companys cost of equity?

-

Suppose you observe the following situation: Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? What is the risk-free rate? Security Beta...

-

Why is paying attention to an interviewers verbal and nonverbal cues as important as responding to questions?

-

From the following, draw up a bank reconciliation statement from details as on 31 December 2012: Cash at bank as per bank column of the cash book Unpresented cheques Cheques received and paid into...

-

Some suggest that a dollar value cannot be placed on life; that is, life is priceless. Explain how the dilemma to social decision created by this view might be resolved.

-

Are jobs that are created as a result of a social project considered as a benefi t, a cost, or both?

-

What role did public health play in the historical decline in mortality rates?

-

Suppose, in Exercise 5, that Johns wage rises from $200 to $210 per day. Show how his equilibrium level of income and laborleisure will change. Exercise 5 Suppose that John chooses to work 200 days...

-

Does current GAAP provide any exceptions to the fair-value measurement principle for business combinations?

-

10m solution. If Ka(HA) = 10 then pOH of solution will be [Given : log4=0.6] (A) 6.7 (B) Greater than 6.7 & less than 7.0 (C) Greater 7.0 & less than 7.3 (D) Greater than 7.3

-

Suppose the Japanese yen exchange rate is 126 = $1, and the British pound exchange rate is 1 = $1.53. a. What is the cross-rate in terms of yen per pound? b. Suppose the cross-rate is 195.8 = 1. Is...

-

The treasurer of a major U.S. firm has $30 million to invest for three months. The annual interest rate in the United States is .17 percent per month. The interest rate in Great Britain is .61...

-

Suppose the current exchange rate for the Polish zloty is Z 3.29. The expected exchange rate in three years is Z 3.41. What is the difference in the annual inflation rates for the United States and...

-

How is decision-making in organizations best supported by Management Accounting (a descriptive nature) and how should it be supported by Management Accounting (a prescriptive nature)? Is there a gap...

-

Discuss the thermodynamic principles governing the separation of azeotropic mixtures using advanced distillation techniques such as pressure swing distillation, extractive distillation, and hybrid...

-

respond to the discussion In the IMA article, Activity-Based Costing (ABC) is explained as a cost allocation technique that traces indirect costs (often referred to as "overhead") to specific cost...

Study smarter with the SolutionInn App