The Fleming Company is considering a new investment. Financial projections for the investment are tabulated below. The

Question:

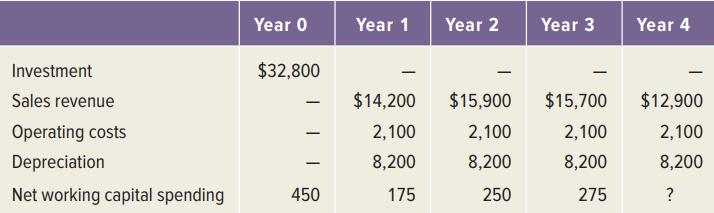

The Fleming Company is considering a new investment. Financial projections for the investment are tabulated below. The corporate tax rate is 22 percent. Assume all sales revenue is received in cash, all operating costs and income taxes are paid in cash, and all cash flows occur at the end of the year. All net working capital is recovered at the end of the project.

a. Compute the incremental net income of the investment for each year.

b. Compute the incremental cash flows of the investment for each year.

c. Suppose the appropriate discount rate is 12 percent. What is the NPV of the project?

Year 0 Year 1 Year 2 Year 3 Year 4 Investment $32,800 Sales revenue $14,200 $15,900 $15,700 $12,900 Operating costs 2,100 2,100 2,100 2,100 | Depreciation 8,200 8,200 8,200 8,200 Net working capital spending 450 175 250 275 ?

Step by Step Answer:

a b We will use the bottomup approach to calculate the operati...View the full answer

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

The Freeman Manufacturing Company is considering a new investment. Financial projections for the investment are tabulated below. The corporate tax rate is 34 percent. Assume all sales revenue is...

-

The Best Manufacturing Company is considering a new investment. Financial projections for the investment are tabulated here. The corporate tax rate is 34 percent. Assume all sales revenue is received...

-

The Dante Manufacturing Company is considering a new investment. Financial projections for the investment are tabulated below. The corporate tax rate is 34 percent. Assume all sales revenue is...

-

The core problem of a command-and-control approach to environmental policy is its inherent bias or tendency to standard-setting practice that is uniformly applicable to all situations. For example,...

-

Geographical Analysis (Jan. 2010) presented a study of emergency medical service (EMS) ability to meet the demand for an ambulance. In one example, the researchers presented the following scenario....

-

Dewey Corp. is expected to have an EBIT of $2.45 million next year. Depreciation, the increase in net working capital, and capital spending are expected to be $180,000, $85,000, and $185,000,...

-

Data for the phosphorylation reaction, R1, are provided by Caliper Life Sciences, Inc., in Figure 25.15 at high [Pep] \(=1.5 \mu \mathrm{M}\) and in Figure 25.16 at high [ATP] \(=250 \mu...

-

A contribution income statement for the La Jolla Inn is shown below. (Ignore income taxes.) Revenue..............................................................................$1,500,000 Less:...

-

Throughout the course, have learned about various concepts in international finance. This assignment provides an opportunity for you to apply those concepts and reflect on important topics in...

-

Three liquid fuels are stored in tanks for use in a blending process. Each fuel is characterized by a demand rate, a fixed replenishment cost, and a unit cost. Inventory carrying costs are assessed...

-

Avignon Restaurant is considering the purchase of a $37,000 souffl maker. The souffl maker has an economic life of six years and will be fully depreciated by the straight-line method. The machine...

-

Down Under Boomerang, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $3.75 million. The fixed asset will be depreciated straight-line to...

-

What are the three primary ways of measuring the effectiveness of public relations campaigns? Briefly discuss each form of measurement

-

What is an annuity problem?

-

A woman selects an outfit consisting of a skirt, scarf, shirt, and a pair of shoes. How many different outfits can she assemble if she has three skirts, two scarves, three shirts, and four pairs of...

-

a. Evaluate: \(\sum_{k=1}^{3}\left(k^{2}-2 k+1ight) \) b. Expand: \(\sum_{k=1}^{4} \frac{k-1}{k+1}\)

-

a. Find the first three terms of the sequences whose nth terms are given. b. Classify the sequence as arithmetic (give d), geometric (give r), both, or neither. \(s_{n}=2-n \)

-

If a family has seven children, in how many ways could the parents have four boys and three girls?

-

Pop Corporation paid $3,000,000 for an 80 percent interest in Son Corporation on January 1, 2016, when the book values and fair values of Son's assets and liabilities were as follows (in thousands):...

-

The following selected accounts and normal balances existed at year-end. Notice that expenses exceed revenue in this period. Make the four journal entries required to close the books: Accounts...

-

An investment in a foreign subsidiary is estimated to have a positive NPV after the discount rate used in the calculations is adjusted for political risk and any advantages from diversification. Does...

-

If a U.S. firm raises funds for a foreign subsidiary, what are the disadvantages to borrowing in the United States? How would you overcome them?

-

If a U.S. firm raises funds for a foreign subsidiary, what are the disadvantages to borrowing in the United States? How would you overcome them?

-

given l o g x 5 = l o g 5 x solve for x

-

Solve the formula 8 x 3 y = - 1 9 for y .

-

Q6 Find the total amount for of the current balance for each underwriter and find out top 10 richest underwriter Q7 Create a pivot table for the entire data and find out the total current balance for...

Study smarter with the SolutionInn App