You have been provided the following data on the securities of three firms, the market portfolio, and

Question:

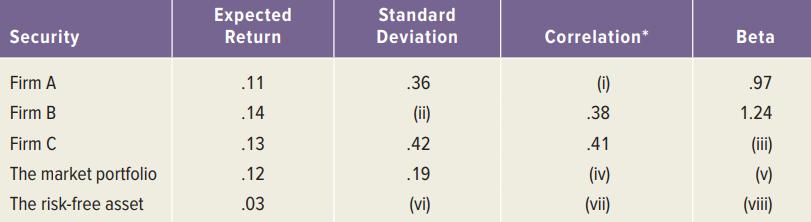

You have been provided the following data on the securities of three firms, the market portfolio, and the risk-free asset:

a. Fill in the missing values in the table.

b. Is the stock of Firm A correctly priced according to the capital asset pricing model (CAPM)? What about the stock of Firm B? Firm C? If these securities are not correctly priced, what is your investment recommendation for someone with a well-diversified portfolio?

Expected Standard Security Return Deviation Correlation* Beta Firm A .11 .36 (i) .97 Firm B .14 (ii) .38 1.24 Firm C .13 .42 .41 (ii) The market portfolio .12 .19 (iv) (v) The risk-free asset .03 (vi) (vii) (vii)

Step by Step Answer:

a i Using the equation to calculate beta we find A AM A M 97 AM 3619 IM 51 ii Using the equation to ...View the full answer

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Related Video

Stocks (also known as equities) are securities that represent ownership in a company. They are issued by companies to raise capital, and when an individual buys stocks, they become a shareholder in that company. Investing in stocks can be a way for individuals to potentially earn a return on their investment through dividends and capital appreciation. However, investing in stocks also carries a level of risk, as the value of the stock can fluctuate based on various factors such as the financial performance of the company and general market conditions. For companies, issuing stocks can be a way to raise funds for growth and expansion. When a company goes public by issuing an initial public offering (IPO), it can raise significant capital by selling ownership stakes to the public. Companies can also issue additional stock offerings to raise additional capital as needed.

Students also viewed these Business questions

-

Fill in the missing values in the table below: Nominal Interest Real Interest Rate Inflation ate 4 3 12 |

-

You have been provided the following information about Kedgwick Company, a small proprietorship, as of the end of its first year of operations. Assume that all supplies were used up at year end. Cash...

-

You have been provided the following information about Lunenberg Ltd. (Lunenberg) as of the end of its first year of operations. Cash collected from customers ..................$413,000 Amounts owing...

-

Which of the following procedures most likely represents an internal control designed to reduce the risk of errors in the billing process? 1. Requiring customers that purchase on account to be...

-

Even if a remote file has not been removed since a hint was recorded, it may have been changed since the last time it was referenced. What other information might it be useful to record?

-

Using the trial balance prepared for Binbutti Engineering in Part 4 of Problem 2-10A, prepare an income statement and statement of changes in equity for the three months ended July 31, 2020, and a...

-

Teller Crackers & Snacks (TCS) recently held a contest in which it awarded each of ten randomly drawn entrants a large box of assorted crackers each week for a year. The names and addresses of the...

-

Electrical heating of a pipe (Fig. 10B.8), in the manufacture of glass-coated steel pipes, it is common practice first to heat the pipe to the melting range of glass and then to contact the hot pipe...

-

[3/10 pts] Analyze the below for loop and find its time complexity function T(n) for (i = 0; i < (3*n + 2); i += 2) { if (i % 5 == 0 ) { // 8 statements; } }

-

A candy bar manufacturer is interested in trying to estimate how sales are influenced by the price of their product. To do this, the company randomly chooses 6 small cities and offers the candy bar...

-

The market portfolio has an expected return of 10.7 percent and a standard deviation of 19 percent. The risk-free rate is 3.2 percent. a. What is the expected return on a well-diversified portfolio...

-

Suppose the expected returns and standard deviations of Stocks A and B are E(R A ) = .10, E(R B ) = .13, A = .41, and B = .59, respectively. a. Calculate the expected return and standard deviation...

-

At the start of the current year, Indigo Corporation (a calendar year taxpayer) has accumulated E & P of $240,000. Indigos current E & P is $160,000, and at the end of the year, it distributes...

-

Using Figure 4.3, explain why a pollution abatement program that reduces discharge beyond Q 1 is ineffi cient. Price P 0 Demand Consumers' Surplus Producers' Surplus Cost to Sellers Figure 4.3...

-

Suppose that John Smith gets promoted to a job that causes two changes to occur simultaneously: John earns a higher wage, and a safer environment causes his health to depreciate less rapidly. How...

-

Identify fi ve distinctive features of the health economy. Examine each one separately, and describe other commodities or sectors that share those features. Do any other commodities or sectors have...

-

A Mudgee Ltd issued the following invoices to customers in respect of credit sales made during the last week of May 2013. The amounts stated are all net of Value Added Tax. All sales made by Mudgee...

-

A D. Faculti started in business buying and selling law textbooks, on 1 January 2012. At the end of each of the next three years, his figures for accounts receivable, before writing-off any bad...

-

The balance sheets of Pop Corporation and Son Corporation at December 31, 2015, are summarized with fair-value information as follows (in thousands): On January 1, 2016, Pop Corporation acquired all...

-

Anna, a high school counselor, devised a program that integrates classroom learning with vocational training to help adolescents at risk for school dropouts stay in school and transition to work...

-

Why doesn't financial distress always cause firms to die?

-

Given that Transocean was down by about 63 percent for 2014, why did some investors hold the stock? Why didn't they sell out before the price declined so sharply?

-

A famous economist just announced in The Wall Street Journal his findings that the recession is over and the economy is again entering an expansion. Assume market efficiency. Can you profit from...

-

Subtract and simplify: 5x-6x+2-(-2-x+2x)

-

In order to value a company, you would need to forecast its future (a key word here) free cash flows. How would you approach this task? Using downloaded real data, try to make the forecast and see,...

-

share five (5) pieces of advice you would give the class about personal financial planning. Explain each. You might go back and look at the introductions in the first discussion for a general,...

Study smarter with the SolutionInn App