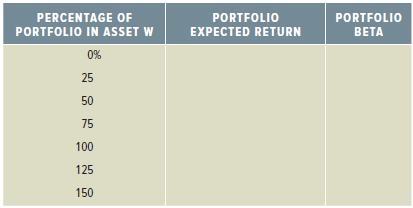

Asset W has an expected return of 10.9 percent and a beta of 1.20. If the risk-free

Question:

Transcribed Image Text:

PORTFOLIO PERCENTAGE OF PORTFOLIO PORTFOLIO IN ASSET W EXPECTED RETURN BETA 0% 25 50 75 100 125 150

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (8 reviews)

First we need to find the of the portfolio The of the riskfree asset is zero and the weight of the r...View the full answer

Answered By

Khurram shahzad

I am an experienced tutor and have more than 7 years’ experience in the field of tutoring. My areas of expertise are Technology, statistics tasks I also tutor in Social Sciences, Humanities, Marketing, Project Management, Geology, Earth Sciences, Life Sciences, Computer Sciences, Physics, Psychology, Law Engineering, Media Studies, IR and many others.

I have been writing blogs, Tech news article, and listicles for American and UK based websites.

4.90+

5+ Reviews

17+ Question Solved

Related Book For

Corporate Finance Core Principles and Applications

ISBN: 978-1259289903

5th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

Asset W has an expected return of 10.5 percent and a beta of .9. If the risk-free rate is 6 percent, complete the following table for portfolios of Asset W and a risk-free asset. Illustrate the...

-

Asset W has an expected return of 11.4 percent and a beta of 1.18. If the risk-free rate is 3.15 percent, complete the following table for portfolios of Asset W and a risk-free asset. Illustrate the...

-

Asset W has an expected return of 12.0 percent and a beta of 1.1. If the risk-free rate is 4 percent, complete the following table for portfolios of Asset W and a risk-free asset. Illustrate the...

-

Allison is paid $1,520 per week. What is the amount of federal income tax withheld from Allisons paycheck under the following conditions? Use the percentage method table in the Appendix to this...

-

In Problem 21 in Chapter 11, we described a study showing that students are likely to improve their test scores if they go back and change answers after reconsidering some of the questions on the...

-

Suppose you have a consumer that calls the lion() method within a Lion service. You have four distinct modules: consumer, service locator, service provider, and service provider interface. If you add...

-

Let \(Z\) be a Brownian motion defined in [0,T]. Given a partition \(\mathscr{P}\) such that \(0=t_{0}

-

Rick and Stacy Stark, a married couple, are interested in purchasing their first boat. They have decided to borrow the boats purchase price of $100,000. The family is in the 28% federal income tax...

-

What are the advantages and disadvantages of divesting through an asset sale or through a spin-off? In your opinion, did Northrop Grumman make the right choice in pursuing a spin-off?

-

The Central Valley Company is a manufacturing firm that produces and sells a single product. The company?s revenues and expenses for the last four months are given below. Required: 1. Management is...

-

A stock has an expected return of 11.5 percent, a beta of 1.09, and the expected return on the market is 10.8 percent. What must the risk-free rate be?

-

Stock Y has a beta of 1.20 and an expected return of 14.1 percent. Stock Z has a beta of .78 and an expected return of 9.5 percent. If the risk-free rate is 4.3 percent and the market risk premium is...

-

Depreciation or Amortization Policy: The methods of depreciation or amortization demonstrated in the chapter include the following: a. Straight- line. b. Units- of- production. c. Declining- balance....

-

Will the 'income tax expense' for an accounting period be the same as the 'income tax payable' at the end of that accounting period?

-

Calculate Gross Pay for a Piecework Employee Sidney Darling is a telemarketer, who is paid $0.31 for every telemarketing call he places. During the most recent week, he worked 42 hours and placed...

-

Windsor Company has 23,500 shares of $1 par common stock issued and outstanding. The company also has 3,100 shares of $100 par 5% cumulative preferred stock outstanding. The company did not pay the...

-

Required: Use the following accounts with normal balances to prepare Bosco Company's classified balance sheet as of December 31. (Click on the Balance Sheet Tab below.) Merchandise inventory $3,000...

-

Malahat Manufacturing Ltd. (Malahat), a publicly traded corporation, is preparing the financial statements for its June 30, Year 2, year end. In following up on an unexpected change in its gross...

-

The percent W of municipal solid waste recovered is shown in the bar graph. The linear model W = 0.33x + 33.1, where x = 1 represents 2008, x = 2 represents 2009, and so on, fits the data reasonably...

-

Revol Industries manufactures plastic bottles for the food industry. On average, Revol pays $76 per ton for its plastics. Revol's waste-disposal company has increased its waste-disposal charge to $57...

-

Assume that the following balance sheets are stated at book value. Suppose that Jurion Co. purchases James, Inc. Then suppose the fair market value of James's fixed assets is $23,000 versus the...

-

Silver Enterprises has acquired All Gold Mining in a merger transaction. Construct the balance sheet for the new corporation if the merger is treated as a purchase for accounting purposes. The market...

-

Penn Corp. is analyzing the possible acquisition of Teller Company. Both firms have no debt. Penn believes the acquisition will increase its total after tax annual cash flow by $1.3 million...

-

Take any two-digit number, where the digits are not the same like 44, or 77. Reverse the digits, to get a second number. One number will be larger than the other number, so now subtract the larger...

-

Simplify 0.25 + 1.8 5s +1 25. 26. 2+3.24 2-25 27. 28. (s+V2)(s-3) 29. 12 228 4s + 32 30. $4 6 2-16 31. s + 10 32-s-2 1 32. (s + a)(s + b)

-

The table below presents the statements of retained earnings for Labelle Corporation for 3 successive years. Certain numbers are missing. Required: Use your understanding of the relationship between...

Study smarter with the SolutionInn App