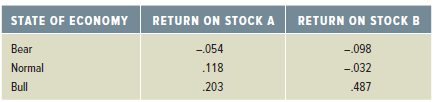

Question: Based on the following information, calculate the expected return and standard deviation of each of the following stocks. Assume each state of the economy is

STATE OF ECONOMY RETURN ON STOCK A RETURN ON STOCKB -098 Bear -054 .118 Normal -.032 .203 Bull 487

Step by Step Solution

3.41 Rating (170 Votes )

There are 3 Steps involved in it

The expected return of an asset is the sum of the probability of each return occurring times the pro... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

1491_605b624b60fd1_647159.pdf

180 KBs PDF File

1491_605b624b60fd1_647159.docx

120 KBs Word File