Because of the dramatic growth at East Coast Yachts, Larissa decided that the company should be reorganized

Question:

1 Closing Case for more detail). Time has passed and, today, the company is publicly traded under the ticker symbol €œECY€.

Dan Ervin was recently hired by East Coast Yachts to assist the company with its short-term financial planning and also to evaluate the company€™s financial performance. Dan graduated from college five years ago with a finance degree,

and he has been employed in the treasury department of a Fortune 500 company since then.

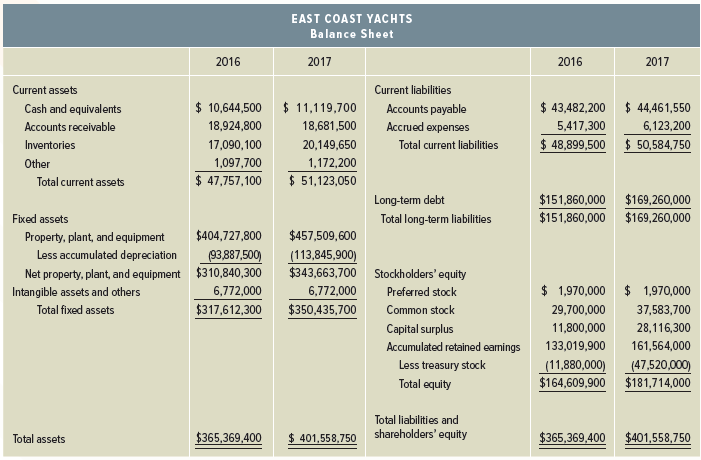

The company€™s past growth has been somewhat hectic, in part due to poor planning. In anticipation of future growth, Larissa has asked Dan to analyze the company€™s cash flows. The company€™s financial statements are prepared by an outside auditor. Nearby you will find the most recent income statement and the balance sheets for the past two years.

Larissa has also provided the following information. During the year, the company raised $40 million in new long-term debt and retired $22.6 million in long-term debt. The company also sold $24.2 million in new stock and repurchased $35.64 million. The company purchased $59.5 million in fixed assets, and sold $6,718,200 in fixed assets.

EAST COAST YACHTS

2017 Income Statement

Sales...................................................................$611,582,000

Cost of goods sold..............................................431,006,000

Selling, general, and administrative...................73,085,700

Depreciation..........................................................19,958,400

EBIT......................................................................$ 87,531,900

Interest expense....................................................11,000,900

EBT........................................................................$ 76,531,000

Taxes........................................................................30,612,400

Net income...........................................................$ 45,918,600

Dividends.................................................................17,374,500

Retained earnings................................................$ 28,544,100

Larissa has asked Dan to prepare the financial statement of cash flows and the accounting statement of cash flows. She has also asked you to answer the following questions:

1. How would you describe East Coast Yachts€™ cash flows?

2. Which cash flows statement more accurately describes the cash flows at the company?

3. In light of your previous answers, comment on Larissa€™s expansion plans.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Corporate Finance Core Principles and Applications

ISBN: 978-1259289903

5th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan