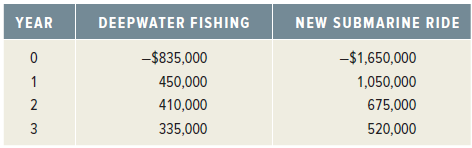

Question: Consider the following cash flows on two mutually exclusive projects for the Bahamas Recreation Corporation. Both projects require an annual return of 15 percent. As

As a financial analyst for the company, you are asked the following questions.

a. If your decision rule is to accept the project with the greater IRR, which project should you choose?

b. Since you are fully aware of the IRR rule€™s scale problem, you calculate the incremental IRR for the cash flows. Based on your computation, which project should you choose?

c. To be prudent, you compute the NPV for both projects. Which project should you choose? Is it consistent with the incremental IRR rule?

NEW SUBMARINE RIDE DEEPWATER FISHING YEAR -$1,650,000 1,050,000 -$835,000 450,000 410,000 675,000 3 335,000 520,000

Step by Step Solution

3.46 Rating (146 Votes )

There are 3 Steps involved in it

a The IRR is the interest rate that makes the NPV of the project equal to zero So the IRR for each project is Deepwater Fishing IRR 0 C 0 C 1 1 IRR C ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

1491_605b624b541ca_647000.pdf

180 KBs PDF File

1491_605b624b541ca_647000.docx

120 KBs Word File