Question: Consider two mutually exclusive new product launch projects that Nagano Golf is considering. Assume the discount rate for both projects is 12 percent. Project A:

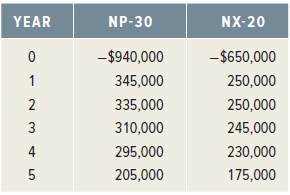

Consider two mutually exclusive new product launch projects that Nagano Golf is considering. Assume the discount rate for both projects is 12 percent.

Project A: Nagano NP-30

Professional clubs that will take an initial investment of $940,000 at Time 0.

Introduction of new product at Year 6 will terminate further cash flows from this project.

Project B: Nagano NX-20

High-end amateur clubs that will take an initial investment of $650,000 at Time 0.

Introduction of new product at Year 6 will terminate further cash flows from this project.

Here are the cash flows:

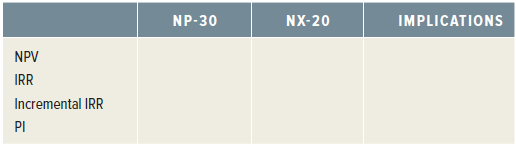

Please fill in the following table:

YEAR NP-30 NX-20 -$940,000 -$650,000 1 345,000 250,000 335,000 250,000 310,000 245,000 4 295,000 230,000 5 205,000 175,000 NP-30 IMPLICATIONS NX-20 NPV IRR Incremental IRR PI

Step by Step Solution

3.23 Rating (161 Votes )

There are 3 Steps involved in it

a The NPV of each project is NPV NP30 940000 345000112 335000112 2 310000112 3 295000112 4 205000112 5 NPV NP30 15954788 NPV NX20 650000 250000112 250... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

1491_605b624b54b5c_647007.pdf

180 KBs PDF File

1491_605b624b54b5c_647007.docx

120 KBs Word File