Question: Sam Dugan is the founder and CEO of Dugan Restaurants, Inc., a regional company. Sam is considering opening several new restaurants. Sally Thornton, the companys

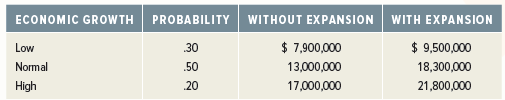

Dugan currently has a bond issue outstanding with a face value of $10.3 million that is due in one year. Covenants associated with this bond issue prohibit the issuance of any additional debt. This restriction means that the expansion will be entirely financed with equity at a cost of $3.7 million. Sally has summarized her analysis in the following table, which shows the value of the company in each state of the economy next year, both with and without expansion.

1. What is the expected value of the company in one year, with and without expansion? Would the= company€™s stockholders be better off with or without expansion? Why?

2. What is the expected value of the company€™s debt in one year, with and without the expansion?

3. One year from now, how much value creation is expected from the expansion? How much value is expected for stockholders? Bondholders?

4. If the company announces that it is not expanding, what do you think will happen to the price of its bonds? What will happen to the price of the bonds if the company does expand?

5. If the company opts not to expand, what are the implications for the company€™s future borrowing needs? What are the implications if the company does expand?

6. Because of the bond covenant, the expansion would have to be financed with equity. How would it affect your answer if the expansion were financed with cash on hand instead of new equity?

PROBABILITY WITHOUT EXPANSION ECONOMIC GROWTH WITH EXPANSION $ 7,900,000 13,000,000 17,000,000 $ 9,500,000 18,300,000 21,800,000 Low 30 Normal .50 High 20

Step by Step Solution

3.48 Rating (171 Votes )

There are 3 Steps involved in it

1 We assume the 37 million is spent at the start of the year so we can ignore time value of money considerations If we include the time value of money the numerical solutions will change slightly but ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

1491_605b624b65033_647242.pdf

180 KBs PDF File

1491_605b624b65033_647242.docx

120 KBs Word File