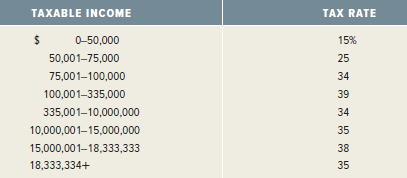

The Alexander Co. had $328,500 in taxable income. Using the rates from Table 2.3 in the chapter,

Question:

Data from Table 2.3

Transcribed Image Text:

TAXABLE INCOME TAX RATE 0-50,000 15% 50,001–75,000 25 75,001–100,000 34 100,001-335,000 39 335,001-10,000,000 34 10,000,001–15,000,000 35 15,000,001–18,333,333 38 18,333,334+ 35

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (10 reviews)

Taxes 1550000 2525000 3425000 39328500 100000 Taxes 111365 T...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Corporate Finance Core Principles and Applications

ISBN: 978-1259289903

5th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

Corporation Growth has $79,500 in taxable income, and Corporation Income has $7,950,000 in taxable income. a. What is the tax bill for each firm? b. Suppose both firms have identified a new project...

-

Corporation Growth has $76,500 in taxable income, and Corporation Income has $7,650,000 in taxable income. a. What is the tax bill for each firm? b. Suppose both firms have identified a new project...

-

Corporation Growth has $89,500 in taxable income, and Corporation Income has $8,950,000 in taxable income. a. What is the tax bill for each firm? b. Suppose both firms have identified a new project...

-

SQL database the yellow box is the Order data mentioned in the Q CoursHeroTranscribedText Orders (cust, date, proc, memory, hd, od, quant, price) Exercise 7.4: In Exercise 6.1 we spoke of PC-order...

-

Portsmouth Company makes upholstered furniture. Its only variable cost is direct materials. The demand for the company's products far exceeds its manufacturing capacity. The bottleneck (or...

-

Write a recursive method to compute the binomial coefficient using the definition shown below: \[ \begin{aligned} \operatorname{binomial}(n, k)=\{ & \text { if } k=0 \text { or } n=k, \text { then }...

-

A food processor claims that at most \(10 \%\) of her jars of instant coffee contain less coffee than claimed on the label. To test this claim, 16 jars of her instant coffee are randomly selected and...

-

Calculating Real Rates of Return If Treasury bills are currently paying 8 percent and the inflation rate is 45 percent, what is the approximate real rate of interest the exact real rate?

-

On July 3, 2009, Devin purchased 100 shares of CDEF stock at a price of $30 per share. The commission paid was $29. He sold his shares on July 6, 2011, at a price of $45 per share and the commission...

-

Assume that A, B, C, D, and E in Figure 20.36 are autonomous systems (ASs). Find the path vector for each AS using the algorithm in Table 20.3. Assume that the best path in this case is the path...

-

Klingon Cruisers, Inc., purchased new cloaking machinery three years ago for $7 million. The machinery can be sold to the Romulans today for $5.3 million. Klingons current balance sheet shows net...

-

Timsung, Inc., has sales of $30,700, costs of $11,100, depreciation expense of $2,100, and interest expense of $1,140. If the tax rate is 40 percent, what is the operating cash flow, or OCF?

-

Visit the Web site of a hotel chain. What does the Web site do to make the product tangible for the customer? Does anything in the site deal with the characteristic of perishables, for example,...

-

Sales representative DeMarino realized that the investment of his time and effort was not for short-term gain, but instead looked to the ___________ the hospital would bring to Medtronic. A....

-

Volunteer, Inc. offers an unconditional return policy to its customers. During the current period, the company records total sales of $850,000, with a cost of merchandise to Heller of $425,000. Based...

-

On adjusted trial balance of Cha Cha Company, the company reports the following information: Retained Earnings $10,300 Sales Revenue $8,000 and Service Revenue $1,250 Rent Expense $3,000, Salaries...

-

The transaction of Padilla Services are recorded in the general journal below. Accounting Transactions Date Account Titles and Explanation Debit ($) Credit ($) Jan. 1 Cash 20,000 Notes Payable 20,000...

-

The term "cost" in health care can mean all of the following EXCEPT: A. The amount paid for a service B. The amount a patient owes C. The amount paid on an invoice for a supply D. The amount paid to...

-

Work each problem. Show that -2/2 -2/2 i is a square root of i.

-

Record the following selected transactions for March in a two-column journal, identifying each entry by letter: (a) Received $10,000 from Shirley Knowles, owner. (b) Purchased equipment for $35,000,...

-

Time Value On subsidized Stafford loans a common source of financial aid for college students, interest does not begin to accrue until repayment begins. Who receives a bigger subsidy, a freshman or a...

-

Calculating EAR Friendlys Quick Loans, Inc., offers you three for four or I knock on your door. This means you get $3 today and repay $4 when you get your paycheck in one week (or else). What the...

-

Present Value of a Growing Perpetuity What is the equation for the present Value of a growing perpetuity with a payment of C one period from today if the payments grow by C each period?

-

Statement of the Problem Supply chain is the most crucial part of any business organization. By examining research data on this topic, there will be a better understanding of whether delays in supply...

-

How do institutions such as education, politics, and the economy contribute to the construction and maintenance of social hierarchies, and how might they be reformed to promote greater equity and...

-

3. The following are the interval times (minutes) between eruptions of a geyser. 86 70 62 98 62 83 73 56 53 92 86 37 78 49 78 37 67 79 57 98 (a) (3 points) What is the 5 number summary? (b) (3...

Study smarter with the SolutionInn App