All of Fun Toys cash inflows come from the sale of toys. Cash budgeting for Fun Toys

Question:

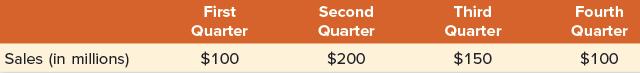

All of Fun Toys’ cash inflows come from the sale of toys. Cash budgeting for Fun Toys starts with a sales forecast for the next year by quarter:

Fun Toys’ fiscal year starts on July 1. Fun Toys’ sales are seasonal and are usually very high in the second quarter due to holiday sales. But Fun Toys sells to department stores on credit and sales do not generate cash immediately. Instead, cash comes later from collections on accounts receivable. Fun Toys has a 90-day collection period and 100 percent of sales are collected the following quarter. In other words:

Collections = Last quarter’s sales This relationship implies that:

Accounts receivable at end of last quarter = Last quarter’s sales (26.6)

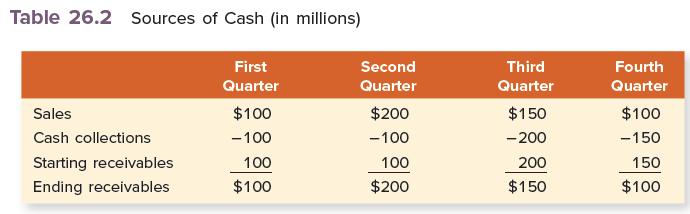

We assume that sales in the fourth quarter of the previous fiscal year were $100 million. From Equation 26.6 we know that accounts receivable at the end of the fourth quarter of the previous fiscal year were $100 million and collections in the first quarter of the current fiscal year are $100 million.

The first-quarter sales of the current fiscal year of $100 million are added to the accounts receivable, but $100 million of collections are subtracted. Therefore, Fun Toys ended the first quarter with accounts receivable of $100 million. The basic relation is:

Table 26.2 shows cash collections for Fun Toys for the next four quarters. Though collections are the only source of cash here, this need not always be the case. Other sources of cash could include sales of assets, investment income, and long-term financing.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe