Elixir Drug Company is expected to enjoy rapid growth from the introduction of its new back-rub ointment.

Question:

Elixir Drug Company is expected to enjoy rapid growth from the introduction of its new back-rub ointment. The dividend for a share of Elixir’s stock a year from today is expected to be $1.15. During the next four years, the dividend is expected to grow at 15 percent per year (g1 = 15%) . After that, growth (g2) will be equal to 10 percent per year. Calculate the present value of a share of stock if the required return (R) is 15 percent.

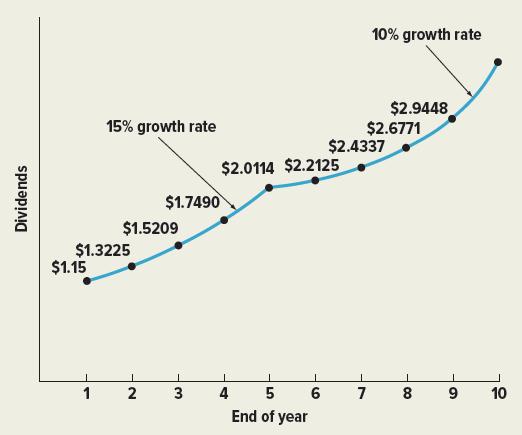

Figure 9.2

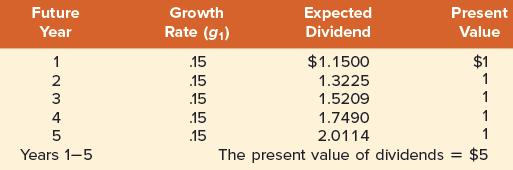

Figure 9.2 displays the growth in Elixir’s dividends. We need to apply a two-step process to discount these dividends. We first calculate the present value of the dividends growing at 15 percent per year. That is, we first calculate the present value of the dividends at the end of each of the first five years. Second, we calculate the present value of the dividends beginning at the end of Year 6. The present values of dividend payments in Years 1 through 5 are calculated as follows:

The growing annuity formula from the previous chapter could normally be used in this step.

However, note that dividends grow at 15 percent per year, which is also the discount rate.

Because g = R, the growing annuity formula cannot be used in this example.

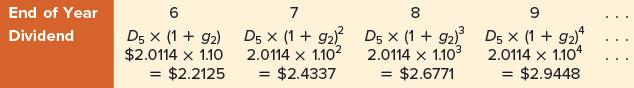

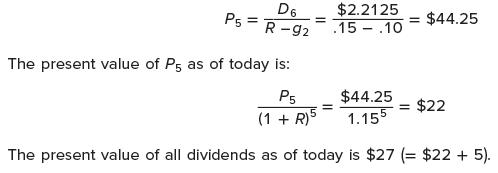

Present Value of Dividends Beginning at End of Year 6 We use the procedure for deferred perpetuities and deferred annuities presented in Chapter 4. The dividends beginning at the end of Year 6 are:

As stated in Chapter 4, the growing perpetuity formula calculates present value as of one year prior to the first payment. Because the payment begins at the end of Year 6, the present value formula calculates present value as of the end of Year 5.

The price at the end of Year 5 is given by:

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe