Suppose Firm A acquires Firm B, creating a new firm, Firm AB. Firm As and Firm Bs

Question:

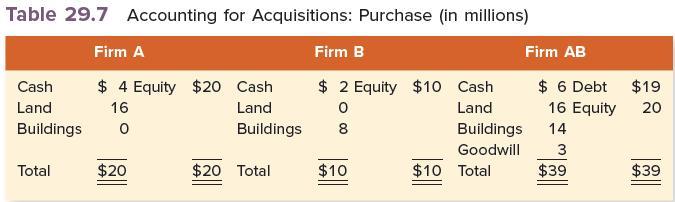

Suppose Firm A acquires Firm B, creating a new firm, Firm AB. Firm A’s and Firm B’s financial positions at the date of the acquisition are shown in Table 29.7.

The book value of Firm B on the date of the acquisition is $10 million. This is the sum of $8 million in buildings and $2 million in cash. However, an appraiser states that the sum of the fair market values of the individual buildings is $14 million. With $2 million in cash, the sum of the market values of the individual assets in Firm B is $16 million. This represents the value to be received if the firm is liquidated by selling off the individual assets separately. However, in business, the whole is often worth more than the sum of the parts. Firm A pays $19 million in cash for Firm B. This difference of $3 million (= $19 million − 16 million) is goodwill.

It represents the increase in value from keeping the firm as an ongoing business. Firm A issued $19 million in new debt to finance the acquisition.

The total assets of Firm AB increase to $39 million. The buildings of Firm B appear in the new balance sheet at their current market value. That is, the market value of the assets of the acquired firm becomes part of the book value of the new firm. However, the assets of the acquiring firm (Firm A) remain at their old book value. They are not revalued upward when the new firm is created.

The excess of the purchase price over the sum of the fair market values of the individual assets acquired is $3 million. This amount is reported as goodwill. Financial analysts generally ignore goodwill because it has no cash flow consequences. Each year, the firm must assess the value of its goodwill. If the value goes down (this is called impairment in accounting speak), the amount of goodwill on the balance sheet must be decreased accordingly. Otherwise, no amortization is required.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe