Suppose the market value of the J. J. Sprint Company is $1,000. The company currently has no

Question:

Suppose the market value of the J. J. Sprint Company is $1,000. The company currently has no debt and each of J. J. Sprint’s 100 shares of stock sells for $10. A company such as J. J. Sprint with no debt is called an unlevered company. Further suppose that J. J. Sprint plans to borrow $500 and pay the $500 proceeds to shareholders as an extra cash dividend of $5 per share. After the issuance of debt, the firm becomes levered. The investments of the firm will not change as a result of this transaction. What will the value of the firm be after the proposed restructuring?

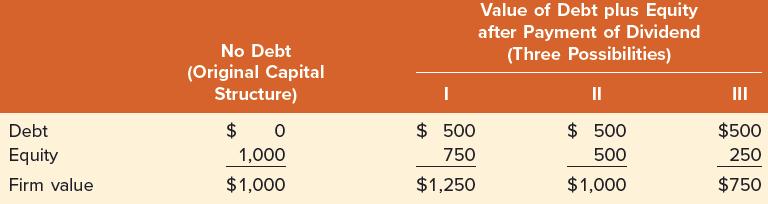

Management recognizes that, by definition, only one of three outcomes can occur from restructuring. Firm value after restructuring can be (1) greater than the original firm value of $1,000, (2) equal to $1,000, or (3) less than $1,000. After consulting with investment bankers, management believes that restructuring will not change firm value more than $250 in either direction. It views firm values of $1,250, $1,000, and $750 as the relevant range. The original capital structure and these three possibilities under the new capital structure are:

Note that the value of equity is below $1,000 under any of the three possibilities. This can be explained in one of two ways. First, the table shows the value of the equity after the extra cash dividend is paid. Because cash is paid out, a dividend represents a partial liquidation of the firm. Consequently, there is less value in the firm for the equityholders after the dividend payment.

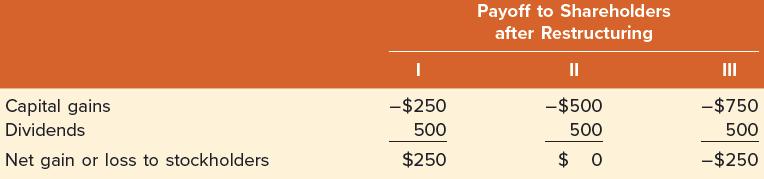

Second, in the event of a future liquidation, stockholders will be paid only after bondholders have been paid in full. The debt is a burden of the firm, reducing the value of the equity. Of course, management recognizes that there are infinite possible outcomes. These three are to be viewed as representative outcomes only. We now can determine the payoff to stockholders under the three possibilities:

No one can be sure ahead of time which of the three outcomes will occur. However, imagine that managers believe that Outcome I is most likely. They should definitely restructure the firm because the stockholders would gain $250. That is, although the price of the stock declines by $250 to $750, they receive $500 in dividends. The net gain is $250 ( = − $250 + 500 ) . Also, notice that the value of the firm would rise by $250 (= $1,250 − 1,000).

Alternatively, imagine that managers believe that Outcome III is most likely. In this case, they should not restructure the firm because the stockholders would incur a $250 loss. That is, the stock falls by $750 to $250 and they receive $500 in dividends. Their net loss is − $250 ( = − $750 + 500 ) . Notice that the value of the firm would change by −$250 (= $750 − 1,000).

Finally, imagine that the managers believe that Outcome II is most likely. Restructuring would not affect the stockholders’ interest because the net gain to stockholders in this case is zero. Notice that the value of the firm is unchanged if Outcome II occurs.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe