The Midland Company is considering expanding operations overseas. It is evaluating Europe and Japan as possible sites.

Question:

The Midland Company is considering expanding operations overseas. It is evaluating Europe and Japan as possible sites. Europe is considered to be relatively safe, whereas operating in Japan is seen as very risky. In both cases, the company would close down operations after one year.

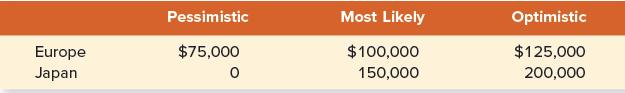

After doing a complete financial analysis, Midland has come up with the following cash flows of the alternative plans for expansion under three scenarios—pessimistic, most likely, and optimistic.

If we ignore the pessimistic scenario, then Japan is the better alternative. When we take the pessimistic scenario into account, the choice is unclear. Japan is riskier because it may deliver zero cash flows under the pessimistic scenario. What is risk and how can it be defined? We must try to answer this important question. Corporate finance cannot avoid coping with risky alternatives and much of our book is devoted to developing methods for evaluating risky opportunities.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe