The monthly cash budget of HYK Communications plc shows that the company will need 18 million in

Question:

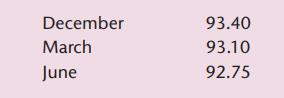

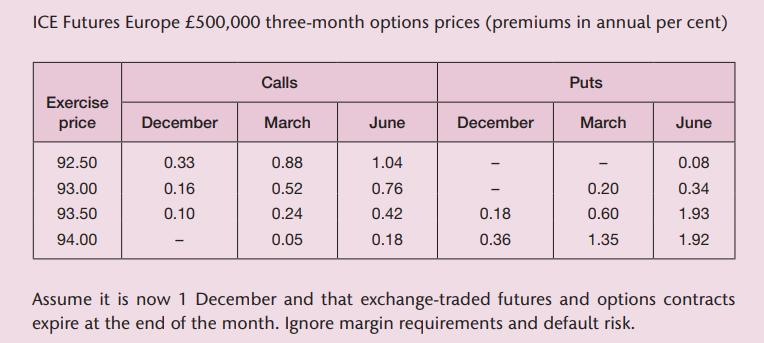

The monthly cash budget of HYK Communications plc shows that the company will need £18 million in two months’ time for a period of four months. Financial markets have been volatile recently and the finance director fears that short-term interest rates could either rise by as much as 150 basis points or fall by 50 basis points. LIBOR is currently 6.5 per cent and HYK can borrow at. LIBOR 0 + .75 per cent the finance director wants to pay no more than 7.50 per cent, including option premium costs, but excluding the effect of margin requirements and commissions. ICE Futures Europe £500,000 three-month futures prices: The value of one tick is £12.50.

Required:

Estimate the results of undertaking EACH of an interest rate futures hedge and an interest rate options hedge on the ICE Futures Europe exchange, if LIBOR:

(i) Increases by 150 basis points;

(ii) Decreases by 50 basis points. Discuss how successful the hedges would have been, stating clearly any assumptions made.

Step by Step Answer:

Corporate Finance Principles And Practice

ISBN: 9781292450940

9th Edition

Authors: Denzil Watson, Antony Head