The Weinstein Corporation has a target capital structure of 80 percent equity and 20 percent debt. The

Question:

The Weinstein Corporation has a target capital structure of 80 percent equity and 20 percent debt. The flotation costs for equity issues are 20 percent of the amount raised; the flotation costs for debt issues are 6 percent. If Weinstein needs $65 million for a new manufacturing facility, what is the true cost including flotation costs?

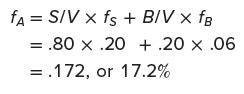

We first calculate the weighted average flotation cost, f A :

The weighted average flotation cost is 17.2 percent. The project cost is $65 million without flotation costs. If we include them, then the true cost is $65 million / (1 − fA) = $65 million / .828 = $78.5 million, again illustrating that flotation costs can be a considerable expense.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe