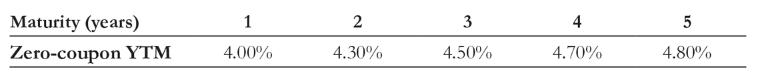

For Problem assume zero-coupon yields on default-free securities are as summarized in the following table: What is

Question:

For Problem assume zero-coupon yields on default-free securities are as summarized in the following table:

What is the price of a three-year, default-free security with a face value of $1000 and an annual coupon rate of 4%? What is the yield to maturity for this bond?

Transcribed Image Text:

Maturity (years) 1 2 3 Zero-coupon YTM 4.00% 4.30% 4.50% 4.70% 4.80%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Answered By

Abdullah Waseem

Hello! I’m Abdullah Waseem! I have completed my graduation in Accounting & Finance from the University of Central Punjab, Lahore. I specialize in Finance, Accounting, Business, Management, Marketing, and Auditing. I have many experiences working as a content developer/writer. I have completed many projects for my clients and I have completed many assignments/expert questions for students globally. I always look for opportunities and for better growth. I’m sure that I will work efficiently with your online website. I have been online tutoring since I was doing my degree. I've helped so many students achieve their academic goals year after year. I always feel good while tutoring the students and providing help to complete their requirements. I can help you in completing the assignments and different projects. I am looking forward to working for you and being able to meet your work requirements and hope to work with you soon as well.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Related Video

The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. This video will give a complete tutorial on how to calculate Yield to Maturity on Microsoft Excel

Students also viewed these Business questions

-

What is the price of a one-year, $50 000 Province of British Columbia treasury bill that yields 1.36% per annum?

-

What is the price of a 91-day, $100 000 Government of Canada Treasury bill that yields 0.53% per annum?

-

What is the price of a 183-day, $500 000 Province of Ontario Treasury bill that yields 1.05% per annum?

-

A standard "35-mm" slide measures 24.0 mm by 36.0 mm. Suppose a slide projector produces a 60.0-cm by 90.0-cm image of the slide on a screen. The focal length of the lens is 12.0 cm. (a) What is the...

-

A $255,000 amount from an RRSP is used to purchase an annuity paying $6000 at the end of each quarter. The annuity provides an annually compounded rate of return of 6%. a. What will be the amount of...

-

What are the four components of planned expenditure, and why did Keynesian analysis emphasize this concept?

-

Evaporative condenser has (a) steam in pipes (b) meter in pipes (c) steam mixed with meter in pipes (d) all of the above

-

Ogundipe Company manufactures a plastic toy cell phone. The following standards have been established for the toys materials and labor inputs: During the first week of July, the company had the...

-

You and your friend each have a graduated cylinder identical to the cylinder 2 from our class. You read a volume of 371mL. Your friend reads a volume of 381mL. On the basis of this information, can...

-

Cary Company manufactures two models of industrial componentsa Standard model and an Advanced Model. It has provided the following information with respect to these two products: Standard Advanced...

-

What does it mean for a country to inflate away its debt? Why might this be costly for investors even if the country does not default?

-

Using the yield curves you have found, estimate the value of an annuity that pays $1000 every 5 years over the next 25 years (i.e., five total payments) paid by either the U.S. Treasury, Microsoft,...

-

What is the output from the following? >>> name = "Barb" >>> name = "Mark" >>> print name

-

1. Most aspects of development are clearly influenced by both nature and nurture. Thinking specifically about physical growth and development, describe at least one way in which nature influences...

-

How do communication strategies such as SBAR (Situation-Background. Assessment-Recommendation) promote patient safety?

-

Tawney worked as a forest firefighter for the Province of Ontario and was a member of the Initial Attack Forest Firefighting crew for a small area in the forests of Northern Ontario. The crew's job...

-

How do homologous chromosomes recognize each other and undergo pairing, leading to the formation of bivalents during prophase I of meiosis?

-

Project S costs $ 2 8 0 0 0 0 and is expected to produce annual cash flows of $ 3 9 2 0 0 for five year plus an additional one time cash flows of $ 2 8 0 0 0 0 at the end of year five. The RR is 6 %...

-

Carrefour has recently given store managers more autonomy in selecting merchandise to sell in their stores. What are the advantages and disadvantages of this policy?

-

President Lee Coone has asked you to continue planning for an integrated corporate NDAS network. Ultimately, this network will link all the offices with the Tampa head office and become the...

-

You are a shareholder in a C corporation. The corporation earns $2.00 per share before taxes. Once it has paid taxes it will distribute the rest of its earnings to you as a dividend. Assume the...

-

Corporate managers work for the owners of the corporation. Consequently, they should make decisions that are in the interests of the owners, rather than in their own interests. What strategies are...

-

Corporate managers work for the owners of the corporation. Consequently, they should make decisions that are in the interests of the owners, rather than in their own interests. What strategies are...

-

PLEASE REFER TO THE SCREENSHOT OF THE OUTPUT BELOW EACH QUESTION AND THE CODE TO ENSURE THAT THE GIVEN ANSWER MATCHES THE OUTPUT AND USES THE CORRECT TABLES SQL CODE(to long to post in text):...

-

Use Adventure Works Database Question 1 will be Sales.SalesOrderDetail table Questtion 2-3requires joining two tables: Sales.SalesOrderDetail and Production.Product 1. Using table...

-

The Driver Relationship team requested to ensure that there will be no duplicates in the active drivers tables in terms of first name, last name and driving license ID. You need to provide constraint...

Study smarter with the SolutionInn App