Suppose equity returns can be explained by the FamaFrench three-factor model: Assume there is no firm-specific risk.

Question:

Suppose equity returns can be explained by the Fama–French three-factor model:

![]()

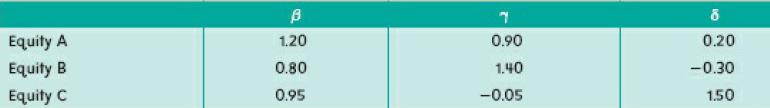

Assume there is no firm-specific risk. The information for each equity is presented here:

The risk premiums for the three factors are 5.5 per cent, 4.2 per cent, and 4.9 per cent, respectively. If you create a portfolio with 20 per cent invested in A, 20 per cent invested in B, and the remainder in C, what is the expression for the return of your portfolio? Assuming that the base return for each equity is 5 per cent and the risk free rate is 5 per cent, what is the expected return of your portfolio?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance

ISBN: 9780077173630

3rd Edition

Authors: David Hillier, Stephen A. Ross, Randolph W. Westerfield, Bradford D. Jordan, Jeffrey F. Jaffe

Question Posted: