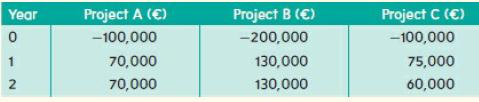

The treasurer of Amaro Canned Fruits has projected the cash flows of projects A, B and C

Question:

The treasurer of Amaro Canned Fruits has projected the cash flows of projects A, B and C as follows.

Suppose the relevant discount rate is 12 per cent a year.

(a) Compute the profitability index for each of the three projects.

(b) Compute the NPV for each of the three projects.

(c) Suppose these three projects are independent. Which project(s) should Amaro accept based on the profitability index rule?

(d) Suppose these three projects are mutually exclusive. Which project(s) should Amaro accept based on the profitability index rule?

(e) Suppose Amaro’s budget for these projects is €300,000. The projects are not divisible.

Which project(s) should Amaro accept?

Step by Step Answer:

Corporate Finance

ISBN: 9780077173630

3rd Edition

Authors: David Hillier, Stephen A. Ross, Randolph W. Westerfield, Bradford D. Jordan, Jeffrey F. Jaffe