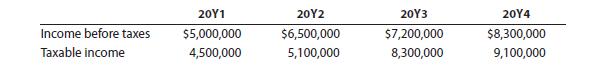

Temporary revenue and expense timing differences between income before income taxes and taxable income for Broadway Suites

Question:

Temporary revenue and expense timing differences between income before income taxes and taxable income for Broadway Suites Inc.’s first four years of operations ended December 31 are as follows:

Assume that the income tax rate for each year is 25% and that all tax payments are made when due.

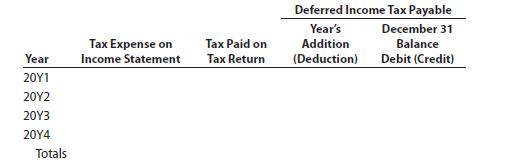

a. Fill in the amounts in the following table for each year:

b. Over the life of a corporation, will the total tax expense on the income statements equal the total tax paid on the tax returns? Explain.

b. Over the life of a corporation, will the total tax expense on the income statements equal the total tax paid on the tax returns? Explain.

c. At any point in the life of a corporation, will there normally be a balance in Deferred Income Tax Payable? If so, will the balance normally be a credit or debit balance? Explain.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: