Question: Select financial statement data for two recent years for Davenport Company are as follows: a. Determine the fixed asset turnover ratio for 20Y4 and 20Y5.

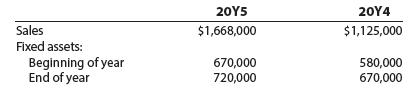

Select financial statement data for two recent years for Davenport Company are as follows:

a. Determine the fixed asset turnover ratio for 20Y4 and 20Y5.

b. Does the change in the fixed asset turnover ratio from 20Y4 to 20Y5 indicate a favorable or an unfavorable change?

20Y5 20Y4 Sales $1,668,000 $1,125,000 Fixed assets: Beginning of year End of year 670,000 720,000 580,000 670,000

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

a To determine the fixed assets turnover ratio for Davenport Company FACR It is a ratio to deter... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

1617_60641d705d413_841216.pdf

180 KBs PDF File

1617_60641d705d413_841216.docx

120 KBs Word File