Assume Stassen Company on January 1, 2020, decides to contract with another company to preassemble a large

Question:

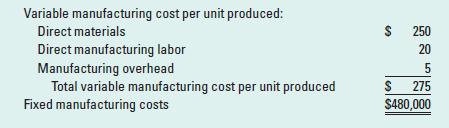

Assume Stassen Company on January 1, 2020, decides to contract with another company to preassemble a large percentage of the components of its telescopes. The revised manufacturing cost structure for Stassen during the 2020–2021 period is as follows:

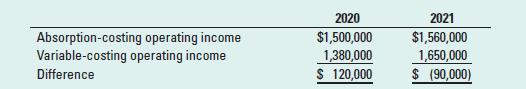

Under the revised cost structure, a larger percentage of Stassen’s manufacturing costs are variable for units produced. The denominator level of production used to calculate budgeted fixed manufacturing cost per unit in 2020 and 2021 is 8,000 units. Assume no other change from the data underlying Exhibits 9-1 and 9-2. Summary information pertaining to absorption-costing operating income and variable-costing operating income with this revised cost structure are as

follows:

Required

1. Compute the budgeted fixed manufacturing cost per unit in 2020 and 2021.

2. Explain the difference between absorption-costing operating income and variable-costing operating income in 2020 and 2021, focusing on fixed manufacturing costs in beginning and ending inventory.

3. Why are these differences smaller than the differences in Exhibit 9-2?

4. Assume the same preceding information, except that for 2020, the master-budget capacity utilization is 10,000 units instead of 8,000. How would Stassen’s absorption-costing income for 2020 differ from the $1,500,000 shown previously? Show your computations.

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9781292363073

17th Global Edition

Authors: Srikant Datar, Madhav Rajan