Question: Denver Data Corp. writes software for computer applications. Recently, one of the company's officers was approached by a representative of a scientific research firm who

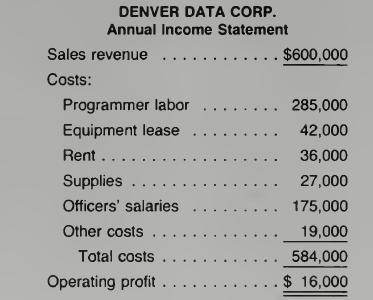

Denver Data Corp. writes software for computer applications. Recently, one of the company's officers was approached by a representative of a scientific research firm who offered a contract to Denver Data Corp. for some specialized programs. Denver Data Corp. reported the following costs and revenues during the past year.

If the company decides to take the contract to produce scientific programs, it will need to hire a full-time programmer at $60,000. Equipment lease would increase by 20 percent because of the need to buy certain computer equipment. Supplies would increase by an estimated 10 percent, and other costs would increase by 20 persent.

The existing building has space for the new programmer. In addition, management believes that no new officers will be necessary for this work.

a. What are the differential costs that would be incurred as a result of taking the contract?

b. If the contract will pay $75,000 in the first year, should Denver Data take the contract?

c. What considerations, other than costs, would be necessary before making this decision?

DENVER DATA CORP. Annual Income Statement Sales revenue $600,000 Costs: Programmer labor 285,000 Equipment lease ... 42,000 Rent...... 36,000 Supplies ... 27,000 Officers' salaries 175,000 Other costs.... 19,000 Total costs... 584,000 Operating profit. . $ 16,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts