Question: Each of the following scenarios is independent. All cash flows are after-tax cash flows. Required: 1. Jim Larsen has purchased a tractor for $125,000. He

Each of the following scenarios is independent. All cash flows are after-tax cash flows.

Required:

1. Jim Larsen has purchased a tractor for $125,000. He expects to receive a net cash flow of $31,250 per year from the investment. What is the payback period for Jim?

2. Sam Rutter invested $240,000 in a laundromat. The facility has a 10-year life expectancy with no expected salvage value. The laundromat will produce a net cash flow of $72,000 per year. What is the accounting rate of return?

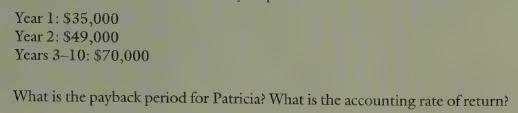

3. Patricia Piel has purchased a business building for $280,000. She expects to receive the following cash flows over a 10-year period:LO1

Year 1: $35,000 Year 2: $49,000 Years 3-10: $70,000 What is the payback period for Patricia? What is the accounting rate of return?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts