Question: (NPV) Jasons Designs has been approached by one of its customers about producing 200,000 special-purpose parts for a new home product. The parts would be

(NPV) Jason’s Designs has been approached by one of its customers about producing 200,000 special-purpose parts for a new home product. The parts would be produced at a rate of 25,000 per year for eight years. To provide these parts, Jason’s would need to acquire new production machines costing a total of $250,000. The new machinery would have no salvage value at the end of its 8-year life.

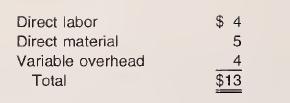

The customer has offered to pay Jason’s $30 per unit for the parts. Ja¬ son’s managers have estimated that, in addition to the new machines, the company would incur the following costs to produce each part:

In addition, annual fixed out-of-pocket costs would be $20,000.

a. Compute the net present value of the machinery investment, assuming that the company uses a discount rate of 9 percent to evaluate capital projects.

b. Based on the NPV computed in part (a), is the machinery a worthwhile investment? Explain.

c. In addition to the NPV, what other factors should Jason’s managers con¬ sider when making the investment decision? LO.1

Direct labor Direct material Variable overhead Total $ 4 5 4 $13

Step by Step Solution

3.53 Rating (146 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts