Question: (Pavback; NPV; Appendix 2) Indiana Industrial Tools is considering adding a new product line that has an expected life of eight years. The product man

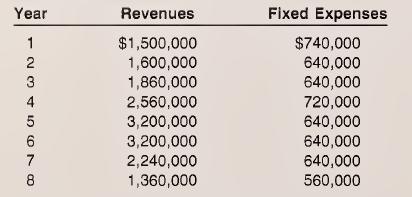

(Pavback; NPV; Appendix 2) Indiana Industrial Tools is considering adding a new product line that has an expected life of eight years. The product man¬ ufacturer would require the firm to incur setup costs of $3,200,000 to handle the new product line. All product line revenues will be collected as earned. Variable costs will average 65 percent of revenues. All expenses, except for the amount of straight-line depreciation, will be paid in cash when incurred. Following is a schedule of annual revenues and fixed operating expenses (including $400,000 of annual depreciation on the investment) associated with the new product line.

The company’s cost of capital is 9 percent. Management uses this rate in discounting cash flows for evaluating capital projects.

a. Calculate the payback period. (Ignore taxes.)

b. Calculate the net present value. (Ignore taxes.)

C. Calculate the accounting rate of return. (Ignore taxes.)

d. Should Indiana Industrial Tools invest in this product line? Discuss the rationale, including any qualitative factors, for your answer.

Year Revenues Fixed Expenses $1,500,000 $740,000 12345678 1,600,000 640,000 1,860,000 640,000 2,560,000 720,000 3,200,000 640,000 3,200,000 640,000 2,240,000 640,000 1,360,000 560,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts