Question: Allocating common costs to joint products by two methods ~ physical units and relative sales value, and computing the profit or loss per quart. The

Allocating common costs to joint products by two methods— ~

physical units and relative sales value, and computing the profit or loss per quart. The manufacturing process in the Cooking Department of the Decorative Paint Company produces two products. Each gallon of raw material placed in production in the department results in 3 quarts of Long Life Coating and 1 quart of Super Glo. Long Life Coating has a sales price of $4 per quart and Super Glo has a sales price of $2.25 per quart. Data for July 19X3 are given below. There was no beginning or ending work in process inventory.

Instructions 1. Compute the cost allocated to each quart of Long Life Coating and the cost allocated to each quart of Super Glo if costs are allocated on the basis of physical units (quarts).

2. Compute the cost allocated to each quart of Long Life Coating and to each quart of Super Glo if common costs are allocated on the basis of relative sales value.

3. Compute the gross profit or loss on Long Life Coating and on Super Glo based on the computations in Instructions 1 and 2.

4. Which of the cost allocation methods used above is preferable? Explain.

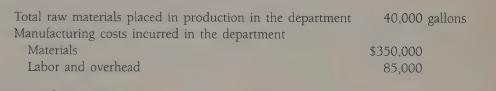

Total raw materials placed in production in the department Manufacturing costs incurred in the department Materials Labor and overhead 40,000 gallons $350,000 85,000

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts