Question: (Appendix) Flexible budgets; two-, three-, and four-variance methods of factory overhead LO 5.6,7 analysis. Similar to self-study problem. Michael Company manufactures a single product and

(Appendix) Flexible budgets; two-, three-, and four-variance methods of factory overhead LO5.6,7 analysis. Similar to self-study problem.

Michael Company manufactures a single product and uses a standard cost system.

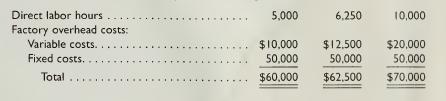

The factory overhead is applied on a basis of direct labor hours. A condensed version of the company's flexible budget follows:

The product requires 3 pounds of materials at a standard cost of $5 per pound and 2 hours of direct labor at a standard cost of $10 per hour.

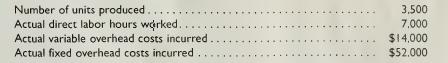

For the current year, the company planned to operate at the level of 6,250 direct labor hours and to produce 3,125 units of product. Actual production and costs for the year follow:

Required:

I. For the current year, compute the factory overhead rate that will be used for production. Show the variable and fixed components that make up the total predetermined rate to be used.

2. Prepare a standard cost card for the product. Show the individual elements of the overhead rate as well as the total rate.

3. Compute

(a) standard hours allowed for production and

(b) under- or overapplied factory overhead for the year.

4. Determine the reason for any under- or overapplied factory overhead for the year by computing all variances, using each of the following methods:

a. two-variance method.

b. three-variance method (appendix).

c. four-variance method (appendix).

Direct labor hours 5,000 6,250 10,000 Factory overhead costs: Variable costs.. $10,000 $12,500 $20,000 Fixed costs. 50,000 50,000 50,000 Total.......... $60,000 $62,500 $70,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts