Question: Choosing an Appropriate Allocation Base in a High-Tech Environment: Silicon Valley Corp. manufactures two types of computer chips. The ROM-A chip is a commonly used

Choosing an Appropriate Allocation Base in a High-Tech Environment: Silicon Valley Corp. manufactures two types of computer chips. The ROM-A chip is a commonly used chip for personal computer systems. The RAM-B chip is used for specialized scientific applications. Direct materials costs for the ROM-A chip are 25 cents per unit and for the RAM-B are 28 cents per unit. The company's annual output is 32 million chips. At this level of output, manufacturing overhead amounts to $2.4 million, and direct labor costs total $625,000.

The company's assembly process is highly automated. As a result, the primary function for direct labor is to set up a production run and to check equipment settings on a periodic basis.

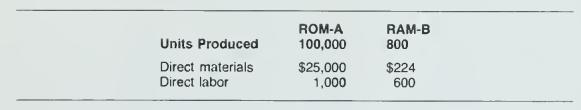

Yesterday the equipment was set up to run 800 RAM-B units. When that run was completed, equipment settings were changed, and 100,000 RAM-A units were produced. Part of the daily cost report is as follows:

Required:

a. For yesterday's production run, what is the total manufacturing cost per unit for ROM-A and RAM-B if direct labor costs are used to allocate manufacturing overhead?

b. For yesterday's production run, what is the total manufacturing cost per unit for ROM-A and RAM-B if units produced is the basis used to allocate manufacturing overhead?

ROM-A RAM-B Units Produced 100,000 800 Direct materials $25,000 $224 Direct labor 1,000 600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts