Question: Determining overhead rates using direct labor cost, direct labor hour, and machine hour methods; determining job cost; computing underapplied and overapplied overhead Con-Aggie Manufacturing Company

Determining overhead rates using direct labor cost, direct labor hour, and machine hour methods; determining job cost; computing underapplied and overapplied overhead Con-Aggie Manufacturing Company is studying the results of applying factory overhead to production. The following data have been used: estimated factory overhead, \(\$ 60,000\); estimated materials costs, \(\$ 50,000\); estimated direct labor costs, \(\$ 60,000\); estimated direct labor hours, 10,000 ; estimated machine hours, 20,000 ; work in process at the beginning of the month, none.

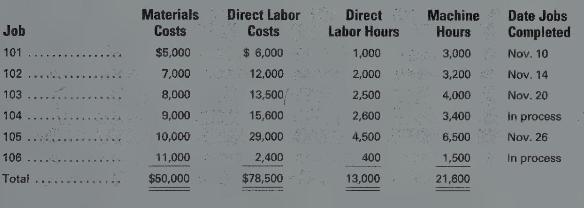

The actual factory overhead incurred for the month of November was \(\$ 75,000\), and the production statistics on November 30 are as follows:

{Required:}

1. Compute the predetermined rate, based on the following:

a. Direct labor cost

b. Direct labor hours

c. Machine hours 2. Using each of the methods, compute the estimated total cost of each job at the end of the month.

3. Determine the under-or overapplied factory overhead, in total, at the end of the month under each of the methods.

4. Which method would you recommend? Why?

Materials Direct Labor Job Costs Costs Direct Labor Hours Machine Hours Date Jobs Completed 101 $5,000 $ 6,000 1,000 3,000 Nov. 10 102... 7,000 12,000 2,000 3,200 Nov. 14 103. 8,000 13,500 2,500 4,000 Nov. 20 104 9,000 15,600 2,600 3,400 in process 105 10,000 29,000 4,500 6,500 Nov. 26 106 11,000 2,400 400 1,500 In process Total $50,000 $78,500 13,000 21,600

Step by Step Solution

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts