Question: Estimate Cash Receipts Using Statistical Forecasting Model: Early in March, the Jackson City administrator presented a budget to the city council. This is four months

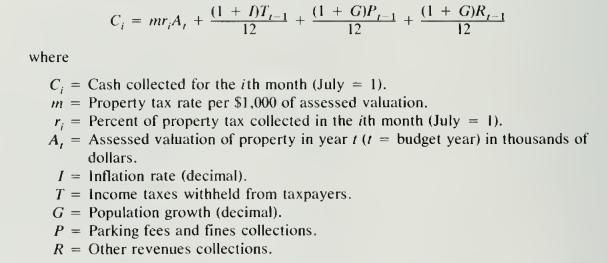

Estimate Cash Receipts Using Statistical Forecasting Model: Early in March, the Jackson City administrator presented a budget to the city council. This is four months prior to the start of the new fiscal year, which begins July I . Most of the important amounts are estimated because the final budget data ( l ) will not be available until much closer to the end of the year or (2) are based upon estimates of events that occur in the next year. City revenues are a good example of the data requirement problem. The city obtains its cash revenues from four sources: property taxes, city income tax, parking fees and fines, and other revenues. Property taxes are based on the assessed valuation of all the property in the city. The final assessment values for the fiscal year are not available until late May. Income tax receipts depend upon the income earned next year by the residents of the city. The parking fees and fines depend, to a large extent, on the size of the population. The city administrator added an estimate of monthly cash receipts and disburse- ments for next year to the budget material he presented to the council. Cash receipts were estimated using a cash forecasting model developed in the controller's depart- ment. The model was the result of statistical analysis of prior years' results and is presented below:

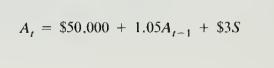

The assessed valuation in thousands of dollars, At was estimated from the regression equation:

where

S = Thousands of square feet of new construction since the last assessment.

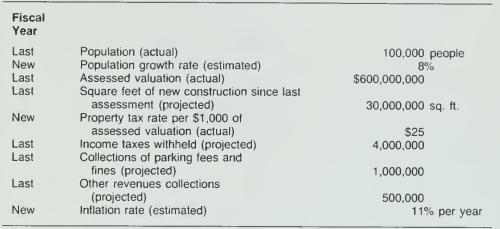

The numerical data shown below was available at the end of February when the budget for this fiscal year was constructed. The data for last fiscal year represents either actual figures or data projected for the entire year based on the first eight months of last fiscal year. The data for the new fiscal year represent either rates or amounts that were actually experienced or estimates of what is expected to be experienced.

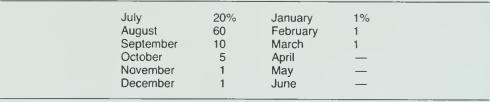

The collection pattern for property taxes that has been experienced the past three years is shown below. City officials expected this pattern to persist in this fiscal year.

Required: Estimate the cash receipts for the month of August that the Jackson City admin- istrator included in the budget material presented to the city council in March. Use the cash forecasting model developed by the controller's department and the data available in February.

(1+DT (1 + G)P (1+ G)R,-1 C = mr,A, + + + 12 12 12 where C; = Cash collected for the ith month (July = 1). m = Property tax rate per $1,000 of assessed valuation. A, I T G P R = = = = = = = Percent of property tax collected in the ith month (July = 1). Assessed valuation of property in year 1 (1 dollars. Inflation rate (decimal). Income taxes withheld from taxpayers. Population growth (decimal). Parking fees and fines collections. Other revenues collections. = budget year) in thousands of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts